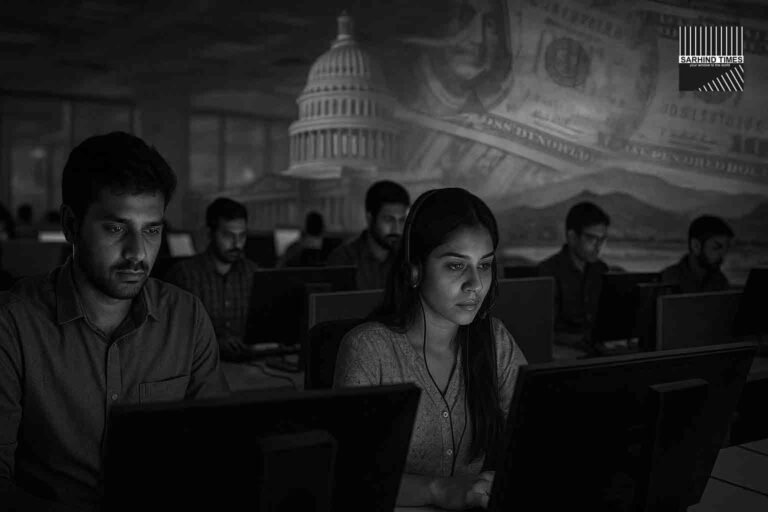

Introduction: A Currency in Crisis

India’s financial markets faced a major jolt on September 11, 2025, as the Indian rupee plunged to a record low of ₹88.4425 against the US dollar. The steep fall has rattled investor sentiment and sent shockwaves through the economy. At the heart of this depreciation lie escalating trade tensions with the United States, where newly announced tariffs on Indian goods have triggered foreign capital flight and heightened pressure on the rupee.

The Tariff Shock: What Triggered the Fall?

The US recently announced a new set of tariffs on Indian exports, targeting textiles, chemicals, and select information technology components. The move, analysts argue, is part of Washington’s broader attempt to address trade imbalances. For India, however, it spells trouble:

- Exporters face reduced competitiveness in global markets.

- Earnings from foreign trade are expected to dip sharply.

- Investor confidence in India’s near-term growth story has weakened.

In the past few weeks alone, foreign portfolio investors (FPIs) have pulled out nearly US$11.7 billion from India’s equity and debt markets, underscoring the seriousness of the situation.

Market Reactions & Government Response

The rupee’s slide immediately pushed bond yields higher, while equities faced heavy selling pressure. In response, the Indian government announced consumption tax cuts aimed at stimulating domestic demand and partially offsetting the export hit.

Additionally, trade officials confirmed that discussions with the US are underway to resolve tariff disputes and negotiate reparations. While New Delhi has not yet announced counter-tariffs, the possibility remains on the table.

RBI’s Intervention: Containing Panic, Not Pegging the Rupee

The Reserve Bank of India (RBI) stepped in by selling dollars from its reserves to reduce volatility in the forex market. However, the central bank has avoided pegging the rupee at a fixed level, opting instead for a managed float.

Economists note that the RBI’s stance is pragmatic: defending the rupee too aggressively would risk depleting forex reserves, while inaction could worsen volatility. By striking a balance, the RBI is signaling resilience while acknowledging market realities.

Broader Impacts on the Indian Economy

The rupee’s record low has multiple spillover effects:

- Import Costs Rising: Oil, machinery, and electronics imports are becoming more expensive, pushing inflationary pressures higher.

- Consumer Goods: From fuel to smartphones, everyday costs for Indian households are set to rise.

- Corporate Sector: Companies with dollar-denominated loans may face repayment stress.

- Export Advantage: While exporters theoretically benefit from a weaker rupee, US tariffs neutralize much of this advantage.

Investor Sentiment: Shaky but Watching Closely

Foreign investors remain cautious. India’s fundamentals—strong GDP growth projections, expanding digital economy, and a young workforce—remain attractive. Yet short-term risks, including trade tensions, global interest rates, and currency volatility, have clouded the picture.

“Until we see clarity on US-India trade negotiations, the rupee may remain under sustained pressure,” said one global investment bank analyst.

Geopolitical Angle: US-India Relations Tested

Beyond economics, the rupee crisis highlights strains in US-India relations. The tariffs arrive at a sensitive time, with India playing a growing role in global supply chains and Washington seeking closer ties in the Indo-Pacific. Analysts say this episode could either:

- Lead to renewed negotiations, resulting in greater cooperation, or

- Widen economic rifts, complicating geopolitical partnerships.

Historical Context: Lessons from Past Crises

India has weathered currency crises before:

- In 2013, the rupee fell sharply during the “taper tantrum” when US Federal Reserve policy shifts triggered outflows.

- In 1991, India faced a full-blown balance-of-payments crisis, forcing it to pledge gold reserves.

Today’s situation is less severe but still concerning. India’s forex reserves remain robust, but rising import bills and uncertain inflows make the outlook fragile.

Analysts’ Outlook: What Lies Ahead?

Experts predict continued volatility in the short term.

- Upside Pressure: If global oil prices rise or if US interest rates remain high, the rupee may face further weakening.

- Stabilizing Factors: A resolution of trade talks, stronger domestic demand, and sustained RBI intervention could provide relief.

- Medium-Term Risks: Persistent outflows and higher inflation could complicate monetary policy, leaving India in a delicate balancing act.

Closing Thoughts: A Test of Resilience

The rupee’s fall to ₹88.44 against the dollar is a wake-up call for policymakers and markets alike. While India’s long-term fundamentals remain intact, the immediate challenge lies in stabilizing investor sentiment, negotiating favorable trade terms, and ensuring inflation does not spiral out of control.

Whether this moment becomes a temporary stumble or a prolonged crisis will depend on swift and coordinated action between New Delhi, the RBI, and India’s global partners.

#IndianRupee #ForexCrisis #TradeTariffs #USIndiaRelations #EconomyAlerts #InvestorSentiment #CurrencyWatch #SarhindTimes

+ There are no comments

Add yours