By SarhindTimes Economy & Technology Bureau | Mumbai / New Delhi | Tuesday, October 21, 2025

In a bold stride toward a cashless and programmable future, the Reserve Bank of India (RBI) on Monday launched the Digital Rupee 2.0 pilot, expanding its Central Bank Digital Currency (CBDC) program to include interbank settlements, retail payments, and programmable smart transactions.

This phase — described as “the bridge between physical currency and digital sovereignty” — allows integration with UPI, NEFT, and blockchain-based clearing networks, making the Indian rupee one of the most technologically advanced legal tenders globally.

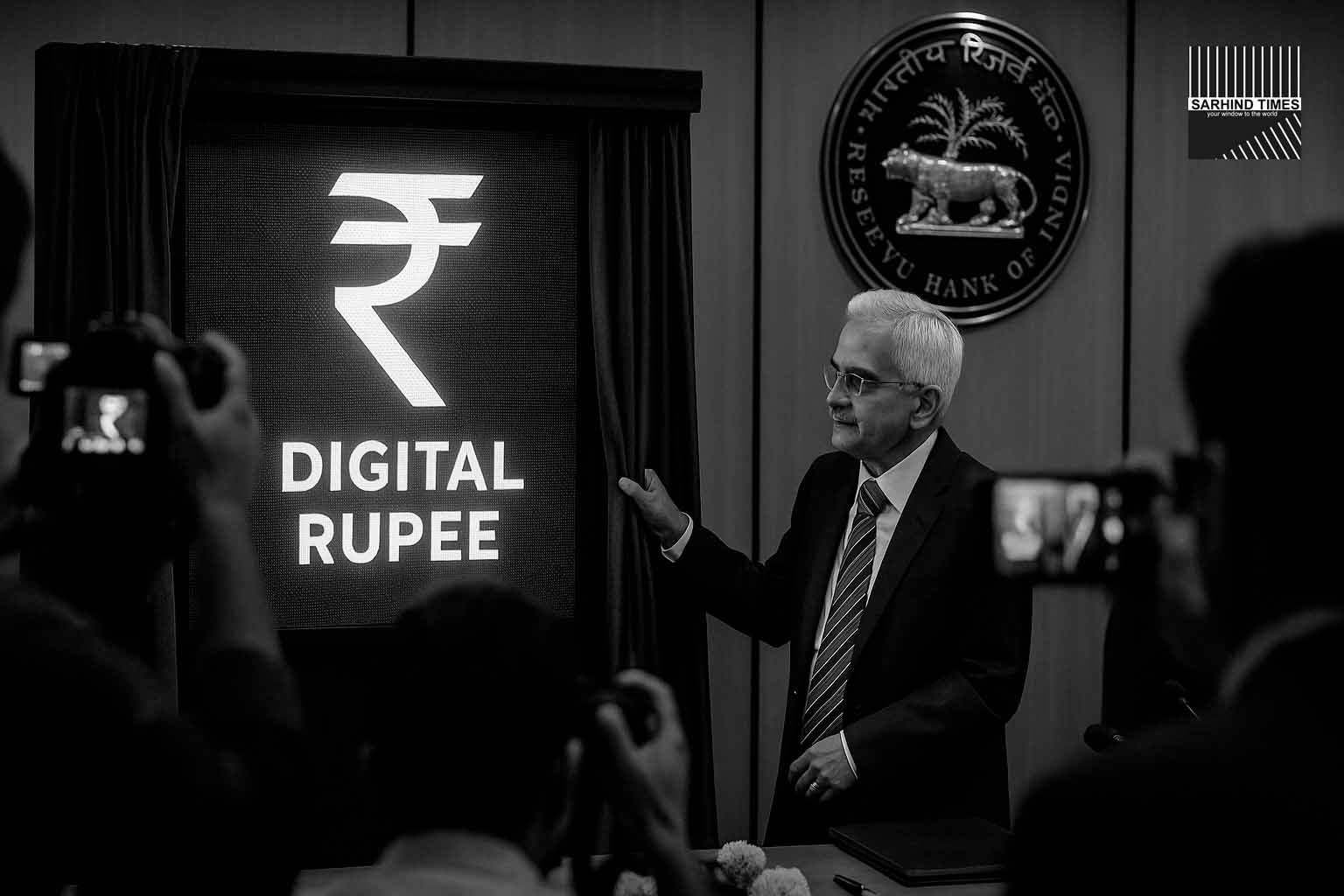

RBI Governor Shaktikanta Das called the move a “historic moment in monetary innovation,” emphasizing that the Digital Rupee (e₹) is not a cryptocurrency but “a sovereign, secure, and fully regulated digital note.”

The Journey So Far

The Digital Rupee project began as a limited wholesale pilot in November 2022, involving major banks for interbank bond settlements.

In December 2022, the retail pilot was launched in select cities for peer-to-peer (P2P) and peer-to-merchant (P2M) payments.

The new 2.0 phase, announced after months of field trials, integrates both ecosystems — retail and wholesale — into a unified framework.

It enables interoperability between banks, payment apps, and government systems while ensuring instant traceability and zero settlement lag.

What’s New in Digital Rupee 2.0

The upgraded version introduces five breakthrough features:

- Interbank Settlement Layer:

Transactions between banks now clear in real-time using blockchain-ledger consensus instead of the old RTGS settlement windows. - Offline Mode:

Users in rural and low-connectivity zones can make payments via Bluetooth and NFC-enabled smart cards, syncing data when connectivity resumes. - Programmable Payments:

Corporates can embed rules — such as payroll release, subsidy conditions, or vendor milestones — directly into tokens. - Cross-Platform Integration:

The e₹ now interoperates seamlessly with UPI, RuPay, and Bharat BillPay for both QR and NFC transactions. - Digital Wallet Expansion:

Citizens can hold Digital Rupees directly in RBI-verified wallets, accessible through banks like SBI, HDFC Bank, ICICI, Axis, and Paytm Payments Bank.

Governor’s Statement

Speaking at the launch in Mumbai, Governor Das declared:

“India is demonstrating that financial inclusion and innovation can coexist within a framework of monetary discipline. The Digital Rupee will be the bedrock of a future-ready economy.”

He noted that more than 20 lakh users and 1.5 lakh merchants have already transacted with the pilot Digital Rupee since 2023, calling the adoption “steady, not speculative.”

Behind the Scenes: How It Works

The Digital Rupee (e₹) functions as a tokenized liability of the RBI — just like cash, but digital.

Each unit carries a unique cryptographic signature, verifiable on a permissioned distributed ledger accessible only to authorized participants.

Transactions remain instant, final, and tamper-proof, unlike card or wallet transactions that rely on intermediaries.

When a user transfers ₹500 in e₹, the amount moves directly from one RBI-backed wallet to another, bypassing third-party processors.

That eliminates payment failures, chargebacks, and settlement delays.

Why Digital Rupee Matters

Economists see three key benefits:

- Efficiency: Reduced transaction costs and faster settlement for businesses and banks.

- Transparency: Auditability reduces the risk of black money and tax evasion.

- Inclusion: Offline and low-data modes bring digital payments to villages previously left out of the fintech revolution.

Dr. Rajeswari Sengupta, professor of economics at IGIDR, explained:

“UPI democratized payments; the Digital Rupee will democratize trust. It’s the next step in India’s fintech evolution.”

Industry Reaction

Bankers and fintech executives hailed the move as transformative.

HDFC Bank CEO Sashidhar Jagdishan said:

“This is not just digital currency; it’s a redefinition of banking infrastructure.”

Meanwhile, PhonePe CEO Sameer Nigam noted that integrating UPI with CBDC “creates the world’s most interoperable payment ecosystem.”

Stock markets reacted positively, with fintech and cybersecurity shares rising 3–5 percent by closing.

Tech Backbone: India’s Blockchain Moment

The RBI Innovation Hub, in collaboration with the Institute for Development and Research in Banking Technology (IDRBT), developed the hybrid blockchain architecture powering e₹2.0.

Unlike open cryptocurrencies such as Bitcoin, this ledger is permissioned, meaning only verified entities (banks, regulators) can validate transactions.

Each transaction block is timestamped and encrypted, ensuring both transparency and privacy.

In technical terms, the Digital Rupee operates on a two-tier model:

- RBI issues e₹ to commercial banks.

- Banks distribute e₹ to end users via apps and wallets.

Security and Privacy Measures

Responding to citizen concerns, the RBI clarified that user identity and transaction data are fully encrypted, following the same privacy standards as traditional banking.

The system uses zero-knowledge proofs, enabling validation without exposing personal details.

In addition, e₹ wallets are protected by biometric authentication, PIN verification, and geo-fencing to prevent misuse.

RBI Deputy Governor T. Rabi Sankar stressed:

“Digital Rupee is private enough for citizens, transparent enough for regulators, and secure enough for the nation.”

Government Integration

The Ministry of Finance confirmed that Digital Rupee tokens will soon be used for:

- Direct Benefit Transfers (DBT)

- Scholarship payments

- Subsidy disbursals (e.g., PM-KISAN, LPG, and MNREGA)

This will ensure that subsidies reach beneficiaries instantly without middlemen or leakage.

Officials also revealed plans to integrate the Digital Rupee into GeM (Government e-Marketplace) for transparent procurement.

Interbank Settlement Revolution

The pilot’s wholesale component could be the most disruptive.

Under current systems, interbank settlements occur via RTGS and NEFT, often taking several minutes to confirm.

Now, with e₹, interbank transfers settle in under 10 seconds, without third-party clearinghouses.

Banks can even execute programmable escrow transactions, reducing risks in securities and derivatives markets.

State Bank of India’s digital transformation chief, Arundhati Singh, said:

“This changes the plumbing of finance. For the first time, money itself becomes code.”

Cross-Border Potential

Although Digital Rupee 2.0 is currently limited to domestic networks, the RBI is in talks with the Bank of Thailand, Central Bank of the UAE, and Monetary Authority of Singapore for cross-border interoperability pilots.

The goal: enable instant remittances between India and partner nations using CBDC corridors — bypassing SWIFT and minimizing forex conversion costs.

If successful, it could reduce remittance charges by 40–60 percent, directly benefiting millions of Indian expatriates.

Public Adoption & Awareness

The RBI has partnered with major banks and fintech platforms to conduct awareness campaigns in Tier-II and Tier-III cities.

Posters across Mumbai, Bengaluru, and Patna read:

“It’s not crypto. It’s your rupee—just smarter.”

Merchants accepting e₹ receive incentives such as fee waivers and cashback.

QR codes compatible with both UPI and e₹ are being rolled out to 2 million outlets nationwide.

Potential Challenges

While optimism runs high, experts flag key concerns:

- Technology Fatigue: Users already have UPI, wallets, and cards. Convincing them to adopt a new system requires tangible benefits.

- Cybersecurity Risks: As a national-scale digital currency, e₹ becomes a prime cyber target.

- Bank Disintermediation: If citizens hold e₹ directly in RBI wallets, banks may lose deposits.

The RBI has set up a Cyber Resilience Command Centre (CRCC) to monitor threats in real time.

Global Context: India Joins the CBDC Club

Over 130 countries are now exploring Central Bank Digital Currencies.

India joins early adopters like China (Digital Yuan), Sweden (e-Krona), and Bahamas (Sand Dollar) — but with a scale unmatched globally.

The IMF recently cited India’s pilot as a “model of balanced innovation and regulation.”

International economists believe that if implemented at full scale, the Digital Rupee could enhance India’s monetary sovereignty and set new global benchmarks in digital governance.

Public Opinion

Early reactions on social media have been enthusiastic.

#DigitalRupee2 trended nationally, with users praising India’s technological ambition.

One comment read:

“UPI was India’s payment revolution; e₹ is its monetary revolution.”

However, privacy advocates urged robust oversight.

Activist Nikhil Pahwa wrote:

“CBDCs must empower citizens, not enable surveillance. Transparency must flow both ways.”

Future Roadmap

By mid-2026, the RBI plans to:

- Roll out cross-border remittance corridors with 5 countries.

- Enable smart contract-based e₹ bonds for MSMEs.

- Expand to rural cooperative banks and NBFCs.

- Launch e₹ savings accounts earning tokenized interest.

Officials believe that by 2030, over 40 percent of India’s transactions could involve the Digital Rupee directly or indirectly.

Conclusion: Sovereignty in Code

The launch of Digital Rupee 2.0 marks not just a technological milestone but a philosophical one — the reimagining of money as code bound by national law and human trust.

India has turned from a digital payment adopter to a monetary innovator, showing the world that inclusive innovation need not compromise security or sovereignty.

As Governor Das concluded his address:

“The rupee’s journey began on paper, moved to plastic, and now enters the realm of code. Yet its value remains eternal — trust in India.”

#DigitalRupee #RBI #Fintech #CBDC #DigitalIndia #Innovation #Economy #Blockchain #UPI #FinanceNews

+ There are no comments

Add yours