India’s stock markets witnessed a spirited performance on Friday, led by automobile major Maruti Suzuki India Ltd. (MSIL). The stock surged by nearly 1.5%, outperforming peers and broader indices, closing near its 52-week high. The rally, supported by heavy trading volumes, reinforced Maruti Suzuki’s position as a bellwether of India’s auto sector and a proxy for consumer sentiment in the country’s economy.

This article dives into the details of Maruti Suzuki’s market move, compares sectoral performance, explores the underlying reasons behind the rally, and analyses what it means for investors, policymakers, and the future of India’s automotive industry.

The Friday Surge: By the Numbers

- Stock Movement: Maruti Suzuki rose by ~1.5%, closing just shy of its 52-week high.

- Trading Volume: Higher-than-average volumes were recorded, a signal of strong institutional participation.

- Broader Market Context:

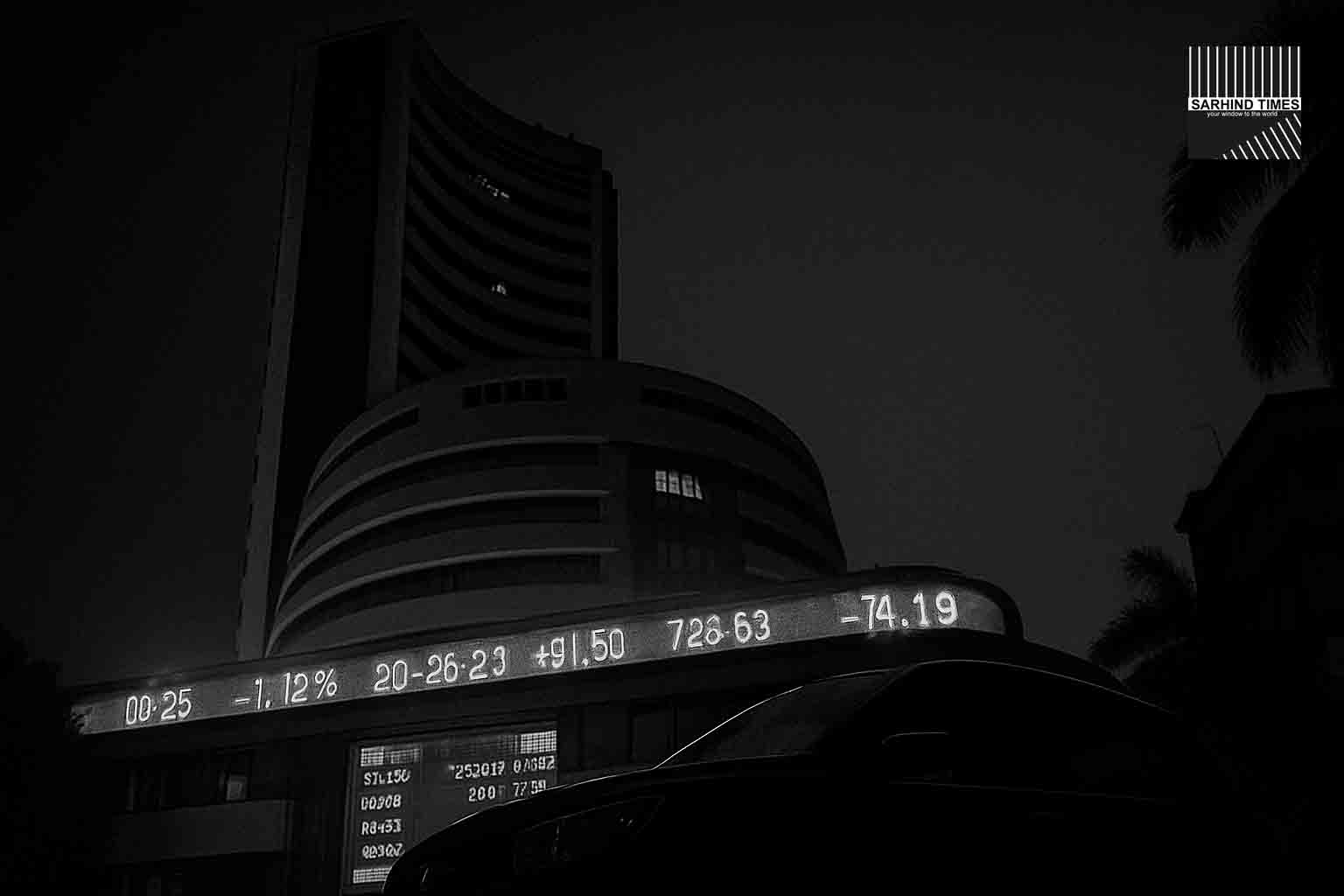

- Sensex gained 0.44%.

- Nifty Auto index posted moderate gains.

- Other large-cap auto names delivered mixed results:

- Eicher Motors: registered stronger growth.

- Ashok Leyland: saw modest gains.

- Smaller auto manufacturers: mixed investor interest.

The day’s performance indicated that the auto sector, though not uniform, is enjoying renewed attention from investors as demand signals turn positive.

Why Maruti Suzuki Outshone the Market

Several factors appear to have converged to give Maruti Suzuki an edge:

1. Favorable Demand Outlook

India’s automobile industry is entering a festive season period—typically a high-demand cycle. With improved rural incomes and stable fuel prices, passenger car sales are expected to rise.

2. Easing Input Costs

Commodity prices—particularly steel and aluminum, critical for automobile production—have softened over recent quarters. This has reduced cost pressures on automakers, helping margins.

3. Government Policy Support

Announcements of incentives for electric vehicle adoption, infrastructure development, and rural credit availability have buoyed investor confidence in auto demand sustaining long-term growth.

4. Brand Leadership

Maruti Suzuki, commanding over 40% of India’s passenger car market, is seen as a stable bet compared to smaller automakers, especially in uncertain global conditions.

5. Institutional Buying

Brokerage reports suggest that foreign institutional investors (FIIs) are rebalancing portfolios with Indian auto stocks, with Maruti Suzuki being a top pick due to its market leadership, balance sheet strength, and alignment with government policies.

Sectoral Snapshot

The Friday session also revealed broader trends in the automobile sector:

- Ashok Leyland: Gains were modest, reflecting volatility in the commercial vehicle market.

- Eicher Motors: Posted stronger growth, thanks to demand for premium motorcycles and export strength.

- Tata Motors & M&M: Showed steady momentum, largely backed by SUV demand and EV prospects.

- Smaller Manufacturers: Witnessed fragmented investor interest, reflecting limited liquidity and varied performance.

Despite differences, the overall auto sector remains a key contributor to market indices, acting as a barometer for India’s consumption-driven growth.

Maruti Suzuki as a Bellwether

Maruti Suzuki’s stock is not just about company performance—it often reflects macro consumer demand in India:

- Rural and Semi-Urban Impact: With expanding rural credit and a good monsoon forecast, rural car demand is expected to rise.

- Urban Premiumisation: The shift towards SUVs and premium hatchbacks has been captured well by Maruti Suzuki’s new product launches.

- EV Strategy: Though slightly behind peers like Tata Motors in EVs, Maruti Suzuki’s hybrid models and strategic partnerships (notably with Toyota) give it a roadmap for future growth.

Thus, Maruti’s rally indicates not just investor optimism about the company but also confidence in India’s consumption recovery cycle.

Analysts’ Take

Brokerages have reacted positively to Maruti’s momentum:

- Morgan Stanley: Highlighted that MSIL remains a “top pick” in Indian auto, citing volume recovery and margin resilience.

- ICICI Securities: Raised its price target, pointing to stable raw material costs and strong festive season expectations.

- Kotak Institutional Equities: Warned that while momentum is strong, valuations are “rich” and could limit upside in the near term.

Challenges Ahead

Despite the positive sentiment, Maruti Suzuki and the wider auto industry face several risks:

- Global Uncertainties: Oil price spikes, geopolitical tensions, or supply-chain disruptions could hurt performance.

- EV Transition: Maruti’s relatively slow entry into fully electric vehicles could pose a competitive risk.

- Interest Rates: Higher financing costs may reduce affordability for consumers.

- Competition: Rivals like Hyundai, Tata Motors, and new EV entrants are aggressively competing in the Indian market.

Broader Economic Context

The surge in Maruti Suzuki also mirrors larger macroeconomic shifts:

- Stock Market Confidence: With Sensex and Nifty posting steady gains, auto is emerging as a growth driver.

- Economic Growth: India’s GDP growth projection of 6.5–7% for FY2025 supports consumer confidence.

- Capital Markets: Investor preference for consumption-oriented sectors shows confidence in India’s domestic demand story despite global headwinds.

Conclusion

Maruti Suzuki’s Friday rally is more than just a stock market event—it’s a signal of investor confidence in India’s automobile industry, consumer demand resilience, and the country’s broader economic trajectory. As the festive season nears, all eyes will be on whether the rally translates into sustained gains for auto stocks.

For investors, Maruti remains a proxy for India’s consumption boom, but the challenge lies in balancing optimism with awareness of global risks and the EV transition race.

#MarutiSuzuki #AutomobileStocks #ShareMarket #IndiaEconomy #EquityBoost #Sensex #Investors #MarketWatch

+ There are no comments

Add yours