Gurgaon, July 2, 2024 — A significant home loan fraud involving at least eight loans totaling ₹4.79 crore has been uncovered in Gurugram. The fraud, which relied on forged property deeds, came to light following a resident’s complaint about the misuse of his KYC documents. The loans were secured from the DLF Qutub Plaza branch of a public sector bank, using fake property deeds for immovable properties in Delhi.

Discovery and Investigation

The fraudulent scheme was revealed when Maneesh Kumar, a resident of Gurugram, filed a complaint with the bank, alleging that his KYC documents had been misused to secure a ₹53.5 lakh home loan against a property in Delhi. Acting on his complaint, senior bank officials ordered a thorough audit of all home loans borrowed for properties in Delhi from the Qutub Plaza branch.

The audit uncovered that 13 individuals had submitted forged property deeds to obtain the loans between August 2020 and September 2021, during the Covid-19 pandemic. Eight of the suspects posed as married couples, while the remaining five acted as individuals.

Details of the Fraud

Investigators revealed that physical verification of properties in Vikas Puri, Paschim Vihar, and Shalimar Bagh in Delhi showed that the rightful owners had never sold their flats to the suspects, who falsely claimed ownership to secure the loans. Further investigation, including collaboration with the Delhi government’s registry office, confirmed that the original property deeds did not match the ones submitted to the bank.

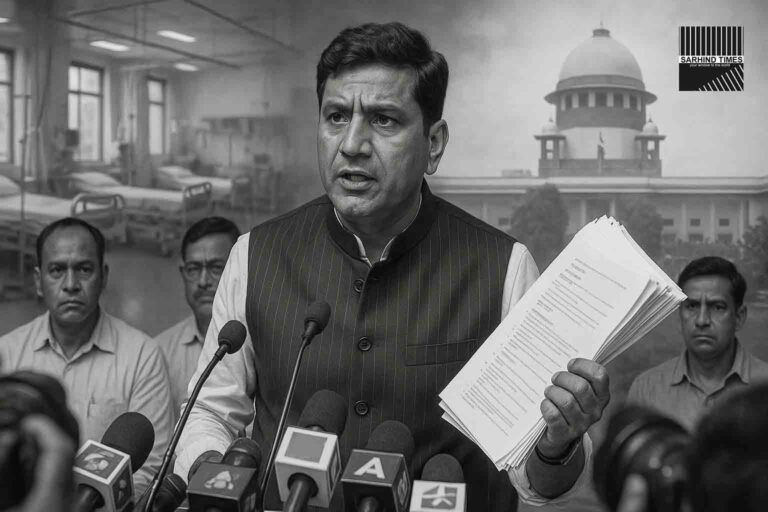

This large-scale fraud prompted Sayed Abdul Khader, the chief manager of the Qutub Plaza branch, to file a formal complaint on April 24, 2023. The Economic Offences Wing (EOW) of the Gurugram Police conducted a detailed inquiry, leading to the registration of an FIR against the 13 suspects.

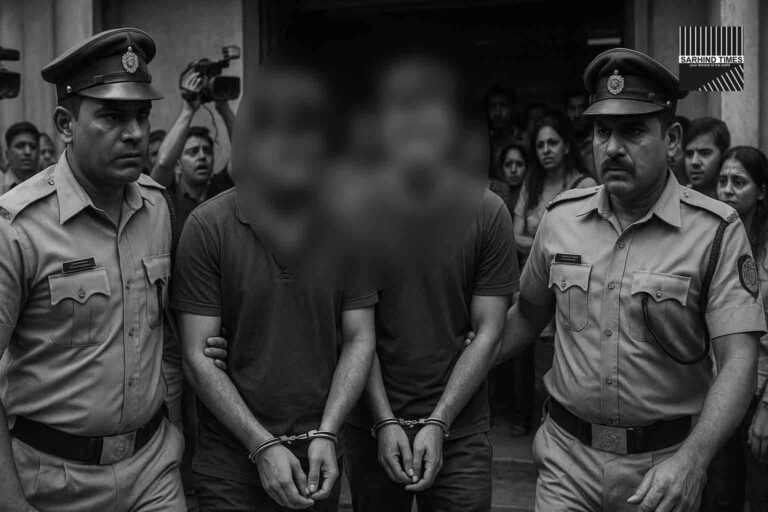

Legal Action and Charges

The suspects have been booked under several sections of the Indian Penal Code (IPC) at DLF Phase-II police station, including:

- Section 120B: Criminal conspiracy

- Section 420: Cheating and dishonestly inducing delivery of property

- Section 467: Forgery of valuable security, etc.

- Section 468: Forgery for purpose of cheating

- Section 471: Using as genuine a forged document

Station House Officer (DLF Phase-II police station), Inspector Shahid Ahmed, stated that the EOW is handling the investigation and that appropriate actions against the suspects will be taken.

Bank’s Response and Next Steps

A senior police officer involved in the case stated, “Following the complaint, senior officials at the bank’s regional office of the Delhi-NCR, asked the concerned branch to conduct a stern audit of all the loans, especially home loans borrowed for properties in Delhi.” The bank is working closely with authorities to ensure all fraudulent activities are thoroughly investigated and addressed.

Conclusion

This incident underscores the importance of stringent verification processes and due diligence in financial transactions. The cooperation between the bank, law enforcement, and government offices has been crucial in uncovering this fraud and bringing the suspects to justice. The investigation continues as authorities aim to safeguard the financial system from such fraudulent activities in the future.

For more updates on this story and other news, visit Sarhind Times.

+ There are no comments

Add yours