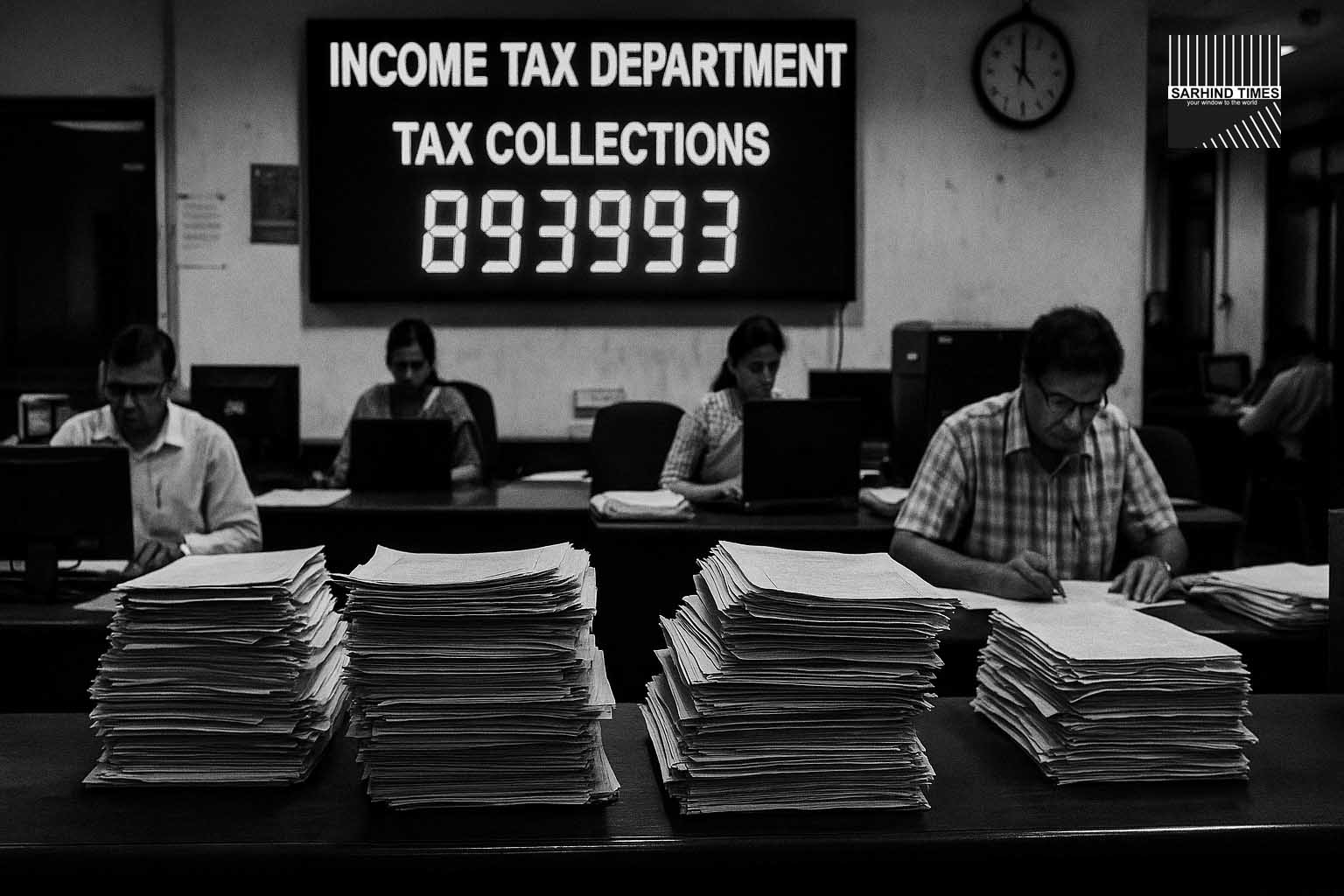

Stronger revenue intake bolsters economy though tax refunds slump signals divergence in taxpayer support

Dateline: New Delhi | November 12, 2025

Summary: The Indian government’s net direct tax collections have grown by 7% year-on-year to over ₹12.9 trillion by November 10, 2025. At the same time, direct tax refunds have dropped 17.7%, raising questions about liquidity management and support for taxpayers even as the economy shows signs of revival.

Revenue surge: What the numbers reveal

India’s tax-mop up during the early part of FY 2025-26 has recorded a significant uptick. The net direct tax collection has crossed the ₹12.9 trillion mark by November 10, reflecting a 7% rise compared to the same period last year. The gross collections have also increased to over ₹15.35 trillion, up slightly from ₹15.02 trillion in the prior year. Meanwhile, direct tax refunds were down by 17.7 percent to about ₹2.42 trillion, compared with ₹2.94 trillion in the same period last year.

While strong collections signal improved enforcement, buoyant economic activity and possibly higher compliance, the drop in refunds poses some questions around cash-flow for businesses and taxpayers.

Drivers of the growth: economy, enforcement and tech

Several factors appear to be contributing to this revenue strength:

– The robust economic revival fed by a strong monsoon, lower oil prices, and supportive monetary/credit environment is translating into higher incomes and profits, which enhance direct tax collections.

– Enhanced tax-department enforcement, better data analytics and compliance monitoring are detecting more tax-payers and reducing leakages.

– The implementation of newer tax-filing infrastructure, digital e-filing, pre-filled returns and improved taxpayer services are raising effective take‐up.

– Corporate profits in some sectors (especially services, financials and tech) appear healthy, helping the headline number.

While these are positive signals, authorities and analysts caution that higher collections alone do not guarantee full economic momentum unless the base is broad, refunds are timely, and future years sustain the trend.

The catch: Falling refunds and distribution concerns

The 17.7 percent fall in tax refunds is apropos. On one level it suggests tighter scrutiny of refund claims, fewer frivolous or unverified claims being approved. On the other hand, delays in refunds can hamper liquidity—especially for businesses relying on such flows for working capital. Stakeholders in the industry are expressing concern that while collections are strongest, the taxpayer-supporting side (warnings, refunds, dispute resolution) might be slipping.

A business-finance executive noted: “Yes, collections are up, but when a cash-flow constrained SME waits for a refund and gets delayed, the upside gets muted.” This tension between revenue growth and taxpayer experience may need to be balanced.

Policymakers may face pressure to accelerate refund processing, ensure transparency, and avoid bottlenecks that could hamper growth in the secondary corporate and SME segments of the economy.

Broader fiscal and macro implications

The improved revenue helps India manage its fiscal space, potentially lowering the borrowing requirement and enabling higher capital expenditure without over-stretching deficits.

For the current fiscal year, the government has already flagged infrastructure and capital-investment spending as its key lever to sustain growth. Higher tax-mop up creates breathing space for such allocations. At the same time, considering global headwinds and policy uncertainty, the revenue performance provides a timely cushion.

Moreover, stronger collections may boost market confidence, support credit-rating assessments and help in reducing risk spreads. It also broadens room for targeted stimulus or relief measures should global shocks hit.

That said, if refunds and taxpayer-support become persistent pain points, structural imbalances may develop—for example, delayed refunds may reduce private-sector investment or slow down growth in the SME sector.

Linkage with other economic indicators

The tax numbers come at a time when India is showing mixed but generally improving macro indicators. The industrial output measure is under reform; the government recently proposed substituting closed factories in the base sample of the Index of Industrial Production (IIP) to improve accuracy. Separately, hiring trends remain strong and inflation remains low, suggesting potential for durable growth.

For example, analysts note that India’s growth cycle appears to be bottoming out, with favourable interest, liquidity and monsoon cycles pointing upward. Real-economy signals thus align with revenue strength.

Additionally, falling inflation, strong consumer demand, real estate uptick and services expansion are consistent with higher tax collections—an encouraging sign.

However, caution remains: structural reforms (labour, land, digital finance) need to keep pace to avoid growth hitting a plateau.

Sectoral and regional breakdown: Who is paying and where?

While the broad headline number is positive, dissecting it reveals interesting nuances. Corporate tax collections, personal income tax uptick and improved compliance among higher-income individuals appear to be contributing more than historically weaker segments. SMEs and micro-enterprises still face challenges. Also, refund delays are more pronounced in the SME segment and among industry’s input-intensive firms, which have higher working capital needs.

Regionally, India’s large states and urban clusters contribute disproportionately. Metropolitan areas and sectors like IT, finance, manufacturing hubs feed more taxes. Rural and semi-urban regions still lag in tax base growth. The government may need to strengthen tax-governance, digital-filing outreach, and taxpayer-education in less well-taxed areas to broaden the base.

Policy takeaways for growth-oriented agendas

From a policy perspective, the performance provides several lessons:

– Sustained investment in taxpayer-service digital infrastructure pays dividends in compliance and broadening the base.

– Linkages between tax-revenues and growth-indicators such as hiring, inflation and industrial output need to be managed. For example, improving refunds supports working capital and drives real-economy spend.

– Monitoring the gap between high-income segments and SMEs is crucial—if smaller businesses feel squeezed, growth may suffer.

– Budget planning can calibrate based on stronger collections: more fiscal head-room, higher CAPEX, and potentially lower borrowing.

– The ongoing reforms to industrial-output measurement and broader structural reforms remain essential to ensure the revenue uptick is not one-off but the start of a durable trend.

Risks that could temper the optimism

Despite the positive headline, several risk factors remain:

– If global policy uncertainty escalates, export demand slows, or commodity-prices surge, India’s incomes and profits may soften.

– If refund delays become systemic and breed mistrust among SME investors, growth may be dampened.

– Tax-compliance gains may plateau if enforcement becomes aggressive rather than cooperative, creating friction and avoidance behaviour.

– Structural bottlenecks—labour, land, supply-chain inefficiencies—remain. Without addressing these, revenue growth may diverge from real-economy strength.

– Measurement and data issues in industrial output, base-year updates and variable sample quality may affect how real growth is interpreted; improved data may also reveal weaker performance than earlier assumed.

What to watch in the coming quarters

Several indicators will determine whether this revenue surge is the beginning of a sustained momentum or a temporary spike:

– The trend of direct-tax collections through Q2 and Q3 of fiscal year 2025-26 — whether the increase holds beyond the early months.

– The pace of direct tax refunds — whether the drop reverses or persists; how working-capital cycles respond.

– The contribution of SMEs, smaller firms, informal economy segments to the tax base — whether the base is widening or growing only in higher-income clusters.

– The impact of the proposed reform to industrial-output measurement, which may change growth estimates and thus influence revenue expectations.

– How fiscal policy responds — whether the government channels the head-room into infrastructure, relief or tax incentives, or if it remains cautious.

– Whether global headwinds such as trade tensions, supply-chain shocks or geopolitics cause slippages and whether India remains resilient.

Implications for businesses, investors and policy-makers

For businesses and investors, the tax-collection numbers signal a favourable macro-backdrop. Investor confidence could improve, credit flows may strengthen and domestic private-investment may receive a boost.

Particularly for larger firms and listed companies, the environment appears supportive. For smaller firms, the key message is caution — ensure refund claims, maintain strong compliance records and monitor cash-flows carefully.

Policy-makers should balance between leveraging the revenue strength and not neglecting the taxpayer experience. Strengthening digital service-delivery, refund speed, guidance to smaller firms and transparent communication become important.

From a growth-perspective, if higher tax collections reflect genuine real-economy expansion rather than just enforcement gains, India may be entering a more sustainable growth phase. But converting revenue strength into broader employment, investment and productivity gains remains the real challenge ahead.

Conclusion

India’s direct tax-collection performance as of early November is a buoyant signal for the economy—7 percent growth in net collections and over ₹12.9 trillion in receipts reflect underlying strength, better compliance and administrative efficiency. Simultaneously, the drop in refunds and regional/SME unevenness remind us that the picture is still incomplete.

The next few quarters will determine whether this momentum can be sustained, whether the tax-base broadens and whether taxpayer-experience improves. For now, the government has gained welcome breathing space for its fiscal and growth agenda—but the real test is turning this into inclusive, high-quality growth rather than just higher tax numbers.

+ There are no comments

Add yours