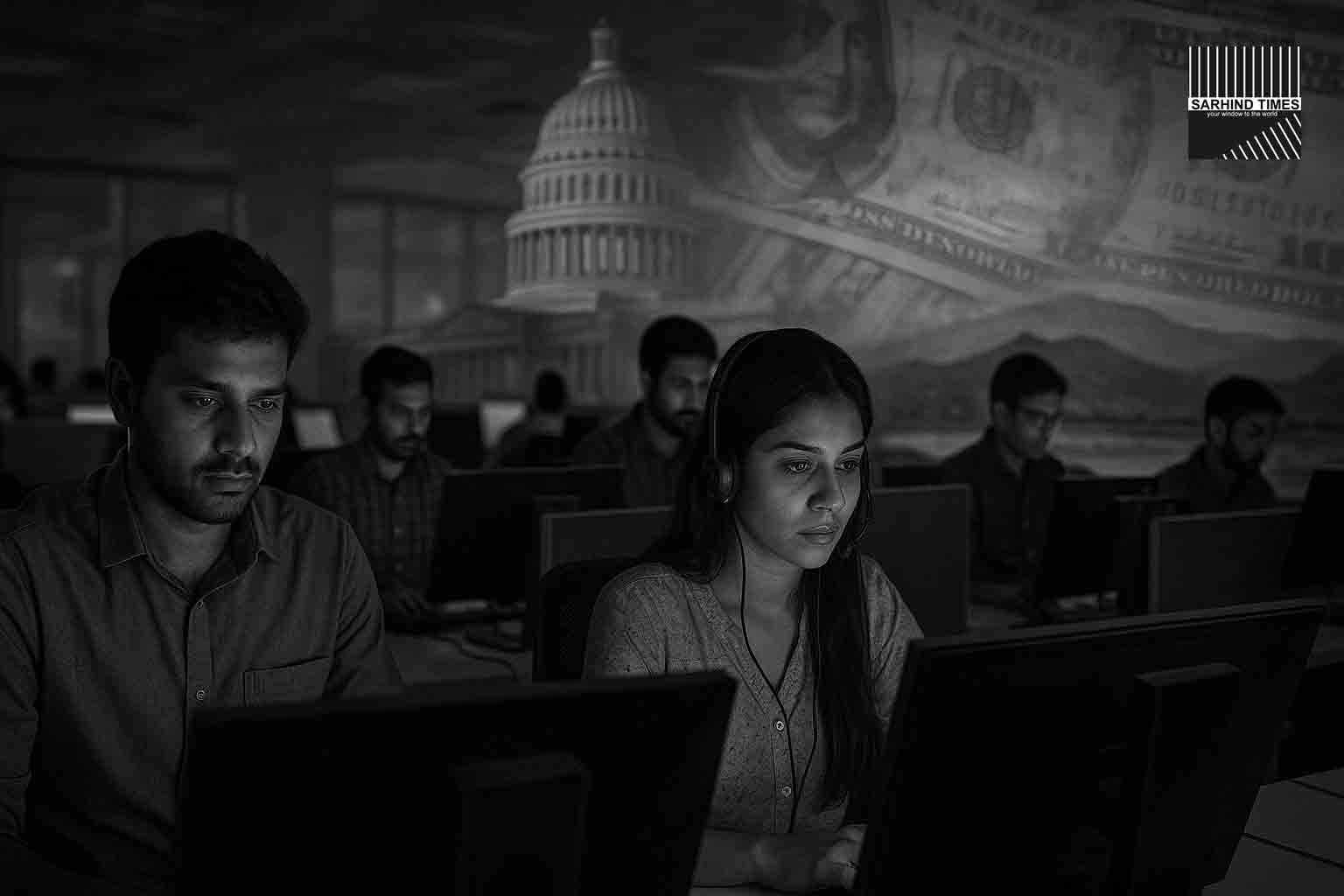

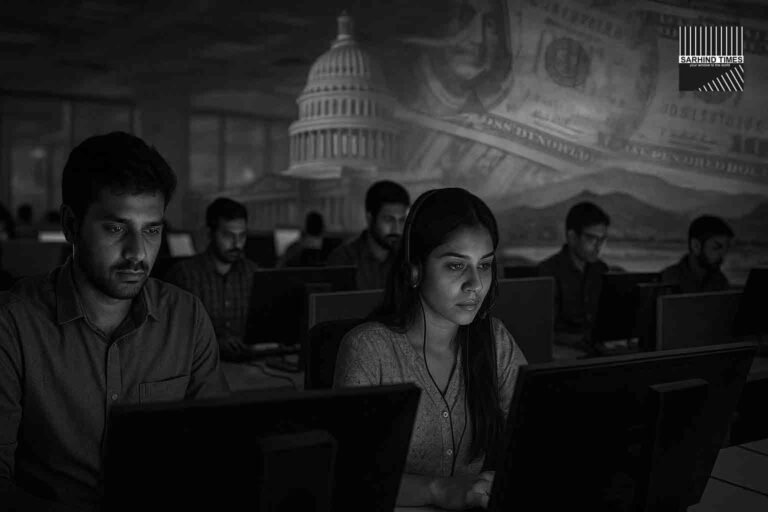

India’s information technology (IT) industry, a cornerstone of the country’s economy and a symbol of its global competitiveness, is staring at a new challenge. The U.S. Congress is debating the HIRE Act, a legislative proposal that seeks to impose a 25% tax on companies that outsource work abroad and limit tax deductions for such services.

For India, where IT exports to the United States account for nearly 60% of sector revenues, the proposal has triggered deep unease. With a market size of $283 billion, the IT industry not only fuels growth but also employs millions. Even the prospect of policy disruption in its largest market is enough to send shockwaves through boardrooms in Bengaluru, Hyderabad, Pune, and Gurugram.

The HIRE Act: What It Proposes

The HIRE Act (Helping Invest in Rethinking Employment) is being pitched in the U.S. as a way to encourage domestic job creation and reduce corporate reliance on offshore outsourcing. Key provisions include:

- A 25% Tax Levy on companies outsourcing work to countries like India, the Philippines, and others.

- Curtailment of Deductions for expenses related to outsourcing contracts, making it costlier for U.S. firms to offshore.

- Incentives for Onshore Hiring, particularly in industries heavily dependent on IT services.

Proponents argue the Act will strengthen American employment and technology resilience. Critics, however, caution it could backfire by raising operational costs for U.S. companies and straining trade ties.

Why India is Worried

India’s IT sector has been built on the strength of outsourcing contracts, providing everything from software development and cloud services to customer support and cybersecurity. The United States has historically been its largest client.

If passed, the HIRE Act could:

- Force U.S. companies to renegotiate contracts, demanding lower costs from Indian providers to offset new tax burdens.

- Encourage localisation of jobs in the U.S., reducing demand for offshore services.

- Increase compliance costs as firms navigate new tax liabilities and reporting requirements.

- Potentially spark a reshuffling of supply chains, diverting business to countries with trade exemptions.

Jignesh Thakkar, compliance head at EY India, summed it up:

“This proposal threatens to alter the economics of outsourcing and significantly increase tax liability associated with cross-border contracts.”

Broader Economic Impact

India’s IT sector contributes over 7% of GDP, anchors $150 billion in annual exports, and supports over 5 million direct jobs. Any disruption could ripple far beyond balance sheets:

- Job Market: Reduced U.S. contracts could slow hiring or even trigger layoffs.

- Startups & SMEs: Smaller IT firms, dependent on niche outsourcing, may be more vulnerable than giants like TCS or Infosys.

- Exchange Rates: Reduced dollar inflows could impact the rupee’s stability.

- Stock Market: Indian IT stocks, often a stabilizing force on indices, may face volatility.

Industry Responses

Indian IT majors are adopting a cautious but proactive approach. Strategies being discussed include:

- Diversification of Markets: Expanding into Europe, Asia-Pacific, and Africa to reduce U.S. dependence.

- Onshore Expansion: Increasing local hiring in the U.S. to blunt the impact of tariffs.

- Value Addition: Moving up the value chain from low-cost coding to high-value consulting, AI, and cloud services.

An industry body, NASSCOM, has already flagged concerns with U.S. counterparts, arguing that restricting outsourcing could harm American competitiveness.

Diplomatic Angle

This isn’t just about economics—it’s also about diplomacy. The proposal reflects broader U.S. trade protectionism and geopolitical pressures, especially in the aftermath of conflicts and shifting supply chains.

For India, which is simultaneously negotiating trade deals with the EU, UK, and Gulf nations, the HIRE Act represents a potential wedge issue in its relationship with Washington. New Delhi must balance its strategic partnership with the U.S. against the practical needs of its IT workforce and economy.

Analysts Weigh In

- Energy Economist Vandana Hari: “The U.S. may gain politically, but companies will face higher costs. India’s IT firms will need to innovate their way out of this challenge.”

- Trade Policy Expert: “This is protectionism by another name. India should engage diplomatically but also prepare backup plans.”

- Tech Entrepreneur (Bengaluru): “For startups, this could be the difference between scaling globally and shutting shop.”

Possible Scenarios

- The Bill Passes as Proposed

- Severe impact on outsourcing revenues.

- Accelerated push by Indian firms to set up more U.S. offices.

- Short-term job losses in India’s IT sector.

- The Bill Passes in Diluted Form

- Limited tax penalties, manageable through contract renegotiations.

- Pressure but not devastation.

- The Bill Fails

- Relief for the sector, but long-term questions about protectionist trends remain.

Conclusion

India’s IT sector is no stranger to challenges—from the dotcom crash to the global financial crisis, it has adapted and thrived. Yet, the HIRE Act represents one of its most direct threats in recent years, combining geopolitical pressure, trade protectionism, and domestic U.S. politics.

How India responds—through diplomacy, diversification, and innovation—will decide whether its IT industry remains a pillar of growth or faces a period of slowdown. For now, boardrooms and policymakers alike are watching Washington closely.

+ There are no comments

Add yours