Under GST 2.0, formal schools and colleges remain exempt from tax, but private coaching and test preparation services continue to be taxed at 18%. Families say this “fee shock” adds up, especially for competitive entrance exam years.

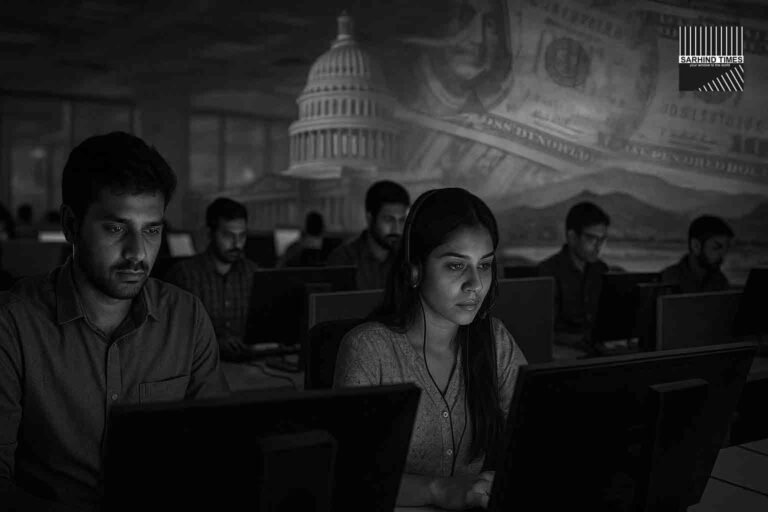

Introduction

When the Indian government rolled out GST 2.0 in September 2025, much of the focus was on simplification and reducing compliance hurdles. But for parents, students, and coaching centres, one aspect stood out sharply: formal schooling and higher education remain tax-free, while private coaching, tuition, and test-prep services stay in the 18% slab.

This distinction has reopened debates about India’s deep-rooted dependence on coaching culture, the burden on middle-class families, and whether tax policy can truly reshape how the nation approaches education.

What Changed Under GST 2.0

- Exempt: Schools (primary to higher secondary), colleges, and universities. Tuition fees remain outside the GST net.

- Taxed: Coaching centres (offline & online), private tuition providers, and exam-prep platforms. These continue to face 18% GST, the standard service rate.

- Practical Impact: A ₹50,000 coaching course now effectively costs a family close to ₹59,000.

Finance Minister Nirmala Sitharaman defended the design, stating:

“Schools and colleges provide formal, recognized education and are exempt. Coaching providers, while valuable, are commercial service providers and thus taxed like any other service.”

Why Families Feel the Pinch

For India’s middle class, already juggling housing EMIs, rising food prices, and healthcare costs, the additional coaching tax feels like another squeeze.

- Competitive Exam Crunch: Students preparing for JEE, NEET, UPSC, CLAT, and CUET often need multiple coaching courses, costing ₹1.5–3 lakh annually. With GST, families now pay ₹25,000–₹50,000 extra in taxes.

- Peer Pressure: Even families reluctant to spend feel compelled as “everyone else” sends their children to coaching.

- Limited Alternatives: Public school infrastructure gaps mean coaching remains non-optional for many ambitious students.

Ravi Verma, a parent in Lucknow, told Sarhind Times:

“We cut down on vacations and even postponed buying a scooter to pay for my daughter’s coaching. Now GST makes it worse. For us, coaching is not luxury—it’s survival in competitive exams.”

Coaching Centres Push Back

Coaching hubs, both traditional and digital, argue that they are being unfairly penalized.

- Offline giants in Kota and Hyderabad warn of declining enrolments and pressure on families.

- Edtech firms like Byju’s, Vedantu, and Unacademy—already struggling after the post-pandemic correction—say higher costs could drive students toward informal tutors who operate without tax compliance.

Rajesh Meena, a coaching director in Kota, said:

“We don’t create the exam system. We only help students navigate it. By taxing us, the government is effectively taxing ambition.”

Critics Question Policy Impact

While the tax makes coaching pricier, educationists argue that it will not reduce dependence on tuition unless deeper reforms are addressed:

- School Quality Gaps: Uneven teaching standards in public and private schools force parents to seek additional support.

- Exam-Centric Culture: Single high-stakes exams create immense pressure, making coaching feel like insurance.

- Lack of Affordable Alternatives: Free or subsidized after-school programs are rare and often underfunded.

Dr. Radhika Menon, an education policy expert, explained:

“Taxes alone won’t fix India’s coaching obsession. What we need is structural reform—better schools, diversified assessments, and accessible academic support for weaker students.”

Equity Concerns: Who Bears the Burden?

The GST impact falls unevenly:

- Wealthier families may absorb the 18% hike with relative ease.

- Middle-class households feel the sharpest pinch, often cutting back on other expenses.

- Lower-income families may drop out of coaching altogether, widening the achievement gap for competitive exams.

This raises questions about fairness in access to opportunities, especially in exams like NEET and JEE, where competition is fierce and margins razor-thin.

Cultural Habits Hard to Change

Beyond economics, the real challenge may be cultural. For decades, Indian families have equated coaching with success, especially in engineering, medicine, and civil services.

Even with GST, parents remain reluctant to “risk” not enrolling their children. As one Bengaluru mother put it:

“Even if I don’t believe in coaching, I can’t deny my son when all his friends are in classes. I won’t gamble with his future.”

What Supporters Say

Proponents of the tax argue that it sends a powerful signal—that schools should be the primary institutions of learning. Over time, the hope is that:

- Families may reduce excessive spending on multiple tuitions.

- Schools may feel pressure to improve quality and reduce reliance on external classes.

- The coaching industry may gradually evolve toward more efficient, affordable models.

But even supporters admit change will be gradual and generational, not immediate.

Possible Next Steps

Experts suggest complementary measures are needed to make the GST distinction effective:

- Strengthening public schools with investment in infrastructure and teacher training.

- Government-backed tutoring for weaker students, especially in rural areas.

- Assessment reforms that reduce single-exam dependency.

- Affordable digital support to bridge learning gaps without high fees.

- Incentives for innovation in pedagogy, not just test prep.

Closing Thought

GST 2.0 has drawn a bold line between schools and coaching, exempting one while taxing the other. For families, the policy means higher bills at a time when educational costs are already daunting. For policymakers, it is a symbolic nudge to re-centre schools as the heart of education.

But unless deeper reforms follow—improving schools, diversifying exams, and offering equitable support—the coaching economy may remain as entrenched as ever.

For now, parents continue to pay the price, both literally and figuratively, as India debates whether tax policy alone can tackle a cultural phenomenon decades in the making.

#GST2 #CoachingCosts #EducationPolicy #SchoolVsTuition #ParentalPressure #AffordableEducation #CompetitiveExams #MiddleClassStrain

+ There are no comments

Add yours