Joint ED–IB operation in Tirupati region traces cross-border money flows tied to previously arrested Chinese national; parallel betting and hawala networks under scanner.

By SarhindTimes Investigation Desk

Tirupati / New Delhi, October 2025

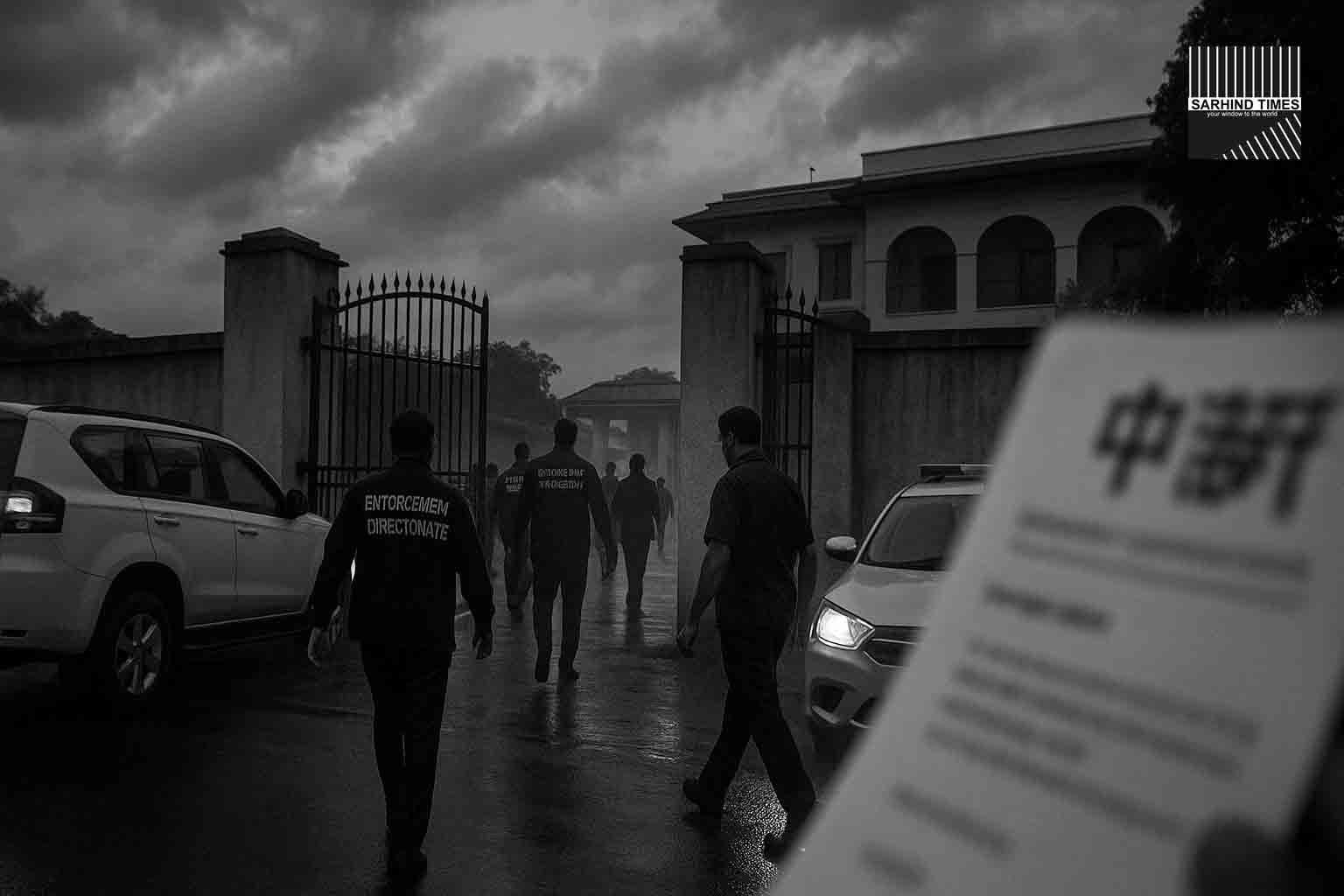

The Operation That Broke the Silence

The Enforcement Directorate (ED) and Intelligence Bureau (IB) have jointly conducted searches across multiple premises near Renigunta and Yerpedu in Andhra Pradesh’s Tirupati district, in a renewed crackdown on financial crimes with cross-border linkages.

At the center of the operation is Du Yongan, a Chinese national previously arrested for illegal stay and hawala transfers, who reportedly maintained financial activities even after prior legal action.

Officials told Sarhind Times that the current operation follows weeks of coordinated intelligence involving suspicious bank account activity, small-business fronts, and links to digital-payment intermediaries used in betting and cyber fraud schemes.

“Our objective is to map every transactional node that connects local mule accounts with international remitters,”

said a senior ED officer involved in the probe.

“Even after deportation proceedings began last year, some financial trails continued to remain active — this raised immediate red flags.”

Ground Zero: Renigunta and Yerpedu

The raids, conducted simultaneously in the Renigunta industrial belt and Yerpedu electronics corridor, covered at least six premises, including a small restaurant, a service apartment, and two storage facilities.

According to preliminary findings, the restaurant in question served as an informal meeting point for Chinese technicians employed in local electronics assembly units.

Investigators suspect the premises doubled as a collection hub for remittances and informal fund transfers, with transactions routed through layered accounts in nearby banks.

“It’s not a large-scale corporate network,” explained a source familiar with the operation.

“It’s a decentralized setup using legitimate businesses as camouflage for irregular flows.”

The searches yielded digital records, multiple bank passbooks, foreign SIM cards, and local ID documents suspected to have been acquired using intermediaries. Officials are now cross-verifying identity details with the Ministry of Home Affairs and FRRO databases.

The Man at the Center: Du Yongan

Du Yongan first came under scanner in late 2023, when local police detained him for visa overstay and suspicious financial activity near Tirupati.

Subsequent ED inquiry revealed possible links to hawala operators funneling money to China and Southeast Asia.

He was booked under the Foreigners Act and the Prevention of Money Laundering Act (PMLA).

While parts of his earlier network were dismantled, investigators now believe that some proxy entities continued operating under local associates, using restaurant and logistics firms as fronts.

“It’s a textbook case of shadow reactivation,” said a retired ED director.

“Once an individual is flagged, the networks often morph, with Indian proxies taking over to keep the channels alive.”

Trail of Transactions

Preliminary bank analysis indicates dozens of small-value transactions made through digital wallets and fintech gateways, aggregating to several crores over months.

The pattern — frequent micro deposits followed by instant withdrawals or cryptocurrency purchases — mirrors trends seen in online betting and mule-account syndicates.

Authorities are examining whether these accounts received funds from betting operators or foreign-controlled crypto wallets disguised as legitimate payment processors.

“The overlap between betting apps, remittance apps, and unregulated wallets is becoming indistinguishable,”

said a cyber-financial expert assisting the case.

“What used to be gambling money is now a mix of investment scams, affiliate marketing, and gaming payouts — all exploiting the same rails.”

Parallel Thread: Betting Networks Under Watch

The Tirupati raids coincide with ongoing ED investigations across Telangana, Karnataka, and West Bengal into illegal online betting networks tied to Southeast Asian operators.

These syndicates use mule accounts — bank accounts opened under locals’ names for commission — to move money between gambling platforms, influencers, and crypto exchanges.

Many of these networks overlap with fraudulent gaming apps and instant loan platforms, exploiting digital loopholes and limited cross-agency visibility.

In recent months, ED has also frozen over ₹160 crore in bank accounts linked to “Dragon Play,” “Fun88,” and “WinGo11”, apps allegedly run from offshore jurisdictions.

“We’re not just chasing betting — we’re chasing the infrastructure that makes it possible,”

an ED spokesperson said in a written reply.

“That includes payment gateways, fake KYC, and complicit banking staff.”

IB’s Role and Cross-Verification

The Intelligence Bureau has been closely involved in the Tirupati case, particularly in background verification of foreign nationals working in electronics, infrastructure, and hospitality sectors in southern India.

IB sources confirm that several temporary staff in local manufacturing units are now being screened for visa irregularities and shell-company employment.

In at least one instance, officials found a common address shared by multiple bank accounts opened months apart — a telltale sign of identity recycling.

“India’s growing industrial zones attract global workers — that’s positive,” said an IB officer, requesting anonymity.

“But the risk lies in parallel ecosystems of informal remittances and unregistered employment.”

Tech Layer: Hawala Meets Fintech

The evolving face of financial crime in India is digital-first.

Traditional hawala — the informal money transfer system — has been reimagined through UPI, prepaid cards, and crypto intermediaries.

In the Tirupati case, investigators found API logs and QR codes linked to small fintech apps that allowed cross-wallet transfers without explicit KYC checks.

Funds were split and re-routed across accounts in seconds, leaving minimal audit trails.

Cyber forensics experts assisting the ED say such fintech-enabled laundering is increasingly used for:

- Crypto off-ramps: converting rupee balances into digital tokens.

- Gaming payouts: masking betting proceeds as legitimate app rewards.

- Micro-mule transactions: distributing large sums into small packets under ₹50,000 to stay below reporting thresholds.

“The problem isn’t UPI,” said Dr. Deepak Mahapatra, fintech analyst.

“It’s misuse by rogue operators who exploit speed and scale — the very strengths of digital India.”

ED’s Broader Enforcement Posture

The Tirupati raids fit into a larger enforcement push aimed at strengthening compliance and cross-agency coordination.

Following recent QR-coded summons rollouts, the ED aims to digitally authenticate all notices to curb impersonation and extortion attempts by fake officers — a growing issue that has undermined public trust.

In tandem, the agency has issued revised guidelines for bank reporting, mandating real-time alerts for transaction bursts — patterns where hundreds of micro deposits hit an account within hours.

“The window for laundering money is shrinking, but criminals are innovating faster,”

observed Pankaj Kumar, retired Enforcement Superintendent.

“It’s a cat-and-mouse game, and AI-led monitoring is now the next frontier.”

Consumer Advisory: Red Flags to Watch

Authorities have urged citizens to remain vigilant against unlicensed gambling platforms and unsolicited money requests.

Typical warning signs include:

- Offers of “investment gaming” or “guaranteed profit” apps.

- UPI requests from unknown accounts using celebrity photos.

- Telegram or WhatsApp groups inviting bets under foreign-sounding brand names.

The Ministry of Electronics and Information Technology (MeitY) recently blocked over 160 illegal gaming websites operating without licenses.

Yet, mirror domains continue to reappear weekly — a pattern that has made digital vigilance a collective responsibility.

The Legal Web: From Visa to Money Laundering

For Du Yongan and his associates, legal exposure now spans multiple statutes — from Foreigners Act violations to FEMA and PMLA.

If investigators establish clear linkage between his local operations and betting or hawala circuits, charges could escalate to criminal conspiracy and cyber fraud.

Lawyers following the case suggest the need for inter-agency prosecution frameworks that bridge immigration, financial, and cybercrime jurisdictions.

“Our laws are compartmentalized — the criminals are not,”

said Advocate Meera Rao, Supreme Court practitioner.

“Coordination between ED, IB, and RBI will define whether such cases lead to convictions or just headlines.”

Why Tirupati Matters

The choice of Tirupati and its adjoining industrial corridor as an operational base is not accidental.

The region’s proximity to Sri City, Chittoor, and electronics manufacturing clusters makes it a melting pot of foreign workers and cross-border suppliers.

Local enforcement officials say this unique blend of industrial footfall and tourism-driven commerce creates opportunities for discreet financial activity — often overlooked amid legitimate trade.

“You can blend in easily here,” said a senior police officer.

“A restaurant serving expats looks normal — until its books don’t match its footfall.”

The Human Angle: Workers Caught in Between

Many local workers employed by foreign-run establishments in the region reportedly lacked formal contracts or digital salary records.

Investigators are assessing whether some were used as nominee account holders in exchange for cash — a growing practice in betting-linked laundering.

Several workers interviewed during searches expressed ignorance, stating that they had “lent their accounts for app withdrawals” believing it to be part-time work.

Such exploitation of digital illiteracy underscores the social cost of fintech misuse.

Technology vs. Transparency

India’s fintech revolution — powered by UPI and low-cost banking — has delivered unprecedented inclusion.

But as this case shows, inclusion without literacy can create shadow economies beneath formal rails.

“For every crore moved legitimately, there’s a fraction that moves illicitly — fast, silent, digital,”

said Dr. Arvind Singh, policy analyst at NIPFP.

“Our enforcement must evolve from reactive raids to predictive oversight.”

Editorial Analysis: The Anatomy of Modern Illicit Finance

The Tirupati sweep captures a defining tension of India’s digital decade: speed versus scrutiny.

As payments accelerate, detection lags.

As compliance tightens, criminals diversify.

Cross-border betting networks now operate like distributed systems, with no single command center — just thousands of micro nodes, each seemingly benign, yet part of a global flow.

In that sense, the raids are as much about asserting sovereignty over digital finance as they are about catching one fugitive.

International Cooperation

The ED has reportedly sought mutual legal assistance (MLA) from counterparts in Singapore and Hong Kong, jurisdictions often used as financial routing hubs for digital gambling companies.

Interpol channels have also been activated to trace associated wallets and overseas shell entities.

“Financial crimes today are not local by design — they’re global by default,”

said a Ministry of Finance official.

“That’s why intelligence fusion matters more than border control.”

The Road Ahead: Regulation Through Reality

As India prepares for the rollout of Digital India Act 2025, cases like this underline the need for integrated risk intelligence platforms that connect banks, fintechs, telecoms, and law enforcement in real time.

Proposals under consideration include:

- AI-based monitoring of abnormal transaction clusters.

- Dynamic blacklisting of mule accounts across all banks.

- Real-time alert systems for users transferring money to flagged wallets.

Conclusion: A Crackdown in Motion

The ED–IB operation near Tirupati may not yet have exposed the full web, but it reflects a sharper, data-driven enforcement posture.

It also marks India’s growing determination to tackle financial crime at the intersection of technology, immigration, and organized gambling.

As one senior investigator put it:

“This isn’t about one man — it’s about how invisible money becomes visible again.”

For the public, the lesson is simple but urgent: every small digital transaction is traceable — and accountability runs both ways.

#ED #Enforcement #Cybercrime #Betting #Tirupati #FinancialCrime #MoneyLaundering #India #CrimeNews #SarhindTimes

+ There are no comments

Add yours