Fake investment platforms, cloned call centres, and WhatsApp trading “gurus” — police trace elaborate interstate racket preying on tech-savvy citizens chasing quick profits.

By Sarhind Times Crime Bureau

Chandigarh | October 19, 2025

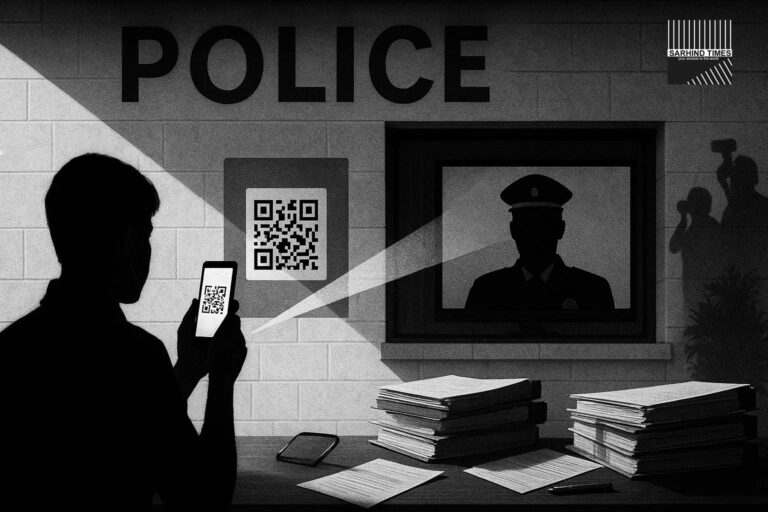

In a breakthrough case exposing the dark underbelly of online investment fraud, the Chandigarh Cyber Crime Investigation Cell has dismantled an organised racket accused of duping citizens of ₹2.87 crore through fake “online trading” platforms.

Two prime suspects — Aditya Verma (28) and Ritesh Singh Tomar (31) — were arrested from Indore, Madhya Pradesh, after a coordinated week-long operation involving cyber-tracking, digital forensics and decoy transactions.

According to police, the accused lured victims via WhatsApp and Telegram groups under the guise of professional “forex and stock trading mentors”. Once trust was built, victims were directed to sophisticated but fraudulent investment websites that mimicked genuine financial portals. The platforms displayed fake dashboards showing “instant profits”, prompting users to invest more — until withdrawal requests were blocked and accounts vanished overnight.

How the Scam Worked: Layered, Luring, and Lethal

Preliminary investigation reveals a three-stage deception model:

- Digital Bait: Ads circulated on social media promising “guaranteed 8–12 % daily returns” through AI-based trading. Influencer-style videos and fake testimonials amplified credibility.

- Trust Hook: Victims were added to closed WhatsApp groups where admins — posing as market analysts — shared manipulated screenshots of profit dashboards.

- Execution & Exit: Once investors transferred funds via UPI or crypto wallets, they received login credentials to fake trading sites. After two or three “successful” withdrawals (a ploy to establish trust), access was cut off, and the domains disappeared.

Police said the network used dynamic IP addresses and SIM cards from eight states, changing phone numbers every 48 hours. The backend servers were hosted on foreign cloud platforms, complicating traceability.

“They ran it like a start-up — daily targets, team incentives, even HR managers for new recruits,” said SP (Cyber) Ketan Bansal, who led the investigation.

“But behind the polish was precision crime.”

Trail of Technology: How the Cops Cracked It

The case began with a complaint filed by a Chandigarh-based architect, who lost ₹12 lakh after being lured by a trading Telegram group called “Profit Hub 360.”

Digital forensics teams traced one of the payment gateways to an account in Bhopal, leading to the arrest of Aditya Verma — a commerce graduate who handled the group’s crypto wallets.

Verma’s interrogation exposed a wider network managed by Ritesh Tomar, operating under pseudonym “Rajiv Malhotra”, who recruited callers from Indore’s local coaching institutes. The group’s operations centre was a rented 2BHK flat fitted with ten computers, noise-cancelling headsets and large TV screens displaying fake live-market feeds.

Investigators recovered 24 SIM cards, 18 bank accounts, and ₹18.4 lakh in cash. Police have frozen additional ₹1.1 crore across linked wallets and payment gateways.

“The syndicate functioned like an offshore BPO of deception,” said Inspector Neha Chandel, part of the raiding team. “Scripts, tone modulation, even emotional manipulation — all rehearsed.”

Victims from Across India

Though the FIR originated in Chandigarh, complainants have surfaced from Delhi, Pune, Jaipur, Bengaluru and Kolkata, suggesting a nationwide spread.

Most victims are educated professionals in their 20s and 30s — freelancers, IT employees and small business owners — who fell for the “AI trading revolution” pitch.

One victim, Rohit Mehta, a 32-year-old marketing executive, recounted:

“They spoke fluent English, showed live dashboards, and even invited us to webinars on ‘financial freedom’. It looked so real that I convinced two friends to join. I realised it was fake only when the site went offline overnight.”

Police estimate over 1,200 people may have been targeted through 40-plus Telegram groups and 60 disposable domains.

The Business of Fraud: From Scripts to CRM

Investigators were stunned by the racket’s professionalism. Each recruit underwent a week-long “sales training”, learning:

- Persuasion psychology (“Fear of Missing Out” pitches)

- Use of foreign accents on international calls

- Entry into victims’ trust circles through personalized greetings

- CRM software to track each target’s “conversion stage”

The gang even employed graphic designers to build authentic-looking dashboards. Domains were registered using privacy protection under foreign registrars to hide ownership.

“This is cybercrime’s franchise model,” noted Professor S.K. Puri, cybersecurity researcher at Punjab Engineering College.

“They mimic corporate ethics while destroying real wealth.”

Inter-State Coordination

The Chandigarh Cyber Cell coordinated with Madhya Pradesh Police, CERT-In, and NPCI’s Fraud Monitoring Division to trace UPI transactions.

Real-time GPS and IP logs from seized routers confirmed that funds were being laundered through digital wallets, prepaid cards and crypto exchanges.

SP Bansal stated that a formal request will be sent to Interpol’s Cyber Wing through the CBI to freeze international wallets identified on the Binance and OKX platforms.

Legal Framework

The accused have been booked under:

- Sections 419 & 420 IPC (cheating & impersonation)

- Section 66D IT Act (cheating by personation using computer resources)

- Section 120B (criminal conspiracy)

Both were produced before a Chandigarh magistrate and remanded to five days’ police custody. The court directed investigators to trace the beneficiary accounts and submit a digital forensic audit within two weeks.

Rising Trend: The New Face of Financial Crime

Cyber-fraud experts say that online-trading scams are now replacing classic “tech-support” or “OTP” frauds. The sophistication of UI, language and digital marketing tools makes detection harder.

As per NCRB 2024 data, India saw over 24,000 cases of online financial fraud with cumulative losses exceeding ₹1,800 crore, a 45 % jump from 2023.

“Scammers are moving from brute-force hacking to behavioural hacking,” said Dr. Ananya Paul, analyst with the Centre for Digital Economy. “They exploit greed and curiosity, not passwords.”

Public Advisory: What Police Urge

The Chandigarh Police have issued a detailed advisory urging citizens to:

- Verify websites on https://cybercrime.gov.in/fraud-sites before investing.

- Avoid unknown WhatsApp/Telegram trading groups.

- Never share UPI PINs, screenshots or OTPs.

- Report suspicious numbers to 1930 (National Cyber Helpline) within 24 hours for fund recovery.

- Cross-check licences of trading firms with SEBI and RBI.

A senior official warned that victims delay reporting out of embarrassment:

“Cyber recovery works best within golden hour — one day. Every minute lost means money vanished into crypto clouds.”

Voices of Accountability

Consumer-rights groups have urged tighter regulation on online financial advertising and stricter action against influencers promoting unverified investment apps.

“Platforms must act as gatekeepers, not megaphones for scams,” argued Nisha Khurana, head of NGO Digital Justice Forum.

Editorial Perspective: Trust in the Time of Trade

The Chandigarh scam is not just a story of fraud — it’s a cautionary mirror for an India rushing headlong into digital finance.

Technology promises empowerment, but when ambition outpaces awareness, manipulation fills the gap.

Rinku Singh’s resilience may make sports headlines; this case exposes the other side of resilience — citizens fighting to reclaim faith in their own screens.

Each click now carries consequence; each chat, potential chicanery.

And while the police may crack cases, the only firewall that lasts is awareness.

#CyberCrime #OnlineTradingScam #ChandigarhPolice #FinancialFraud #DigitalIndia #CyberAwareness #SarhindTimes

+ There are no comments

Add yours