Category: Markets & Finance

Sensex, Nifty End Higher as Banks, Autos Drive Gains — Investors Eye Q2 Earnings and Inflation Data

India’s benchmark indices extended their winning streak, buoyed by gains in banking, auto, and power stocks. Investor optimism held firm ahead of key inflation and [more…]

RBI Pilots Tokenised Deposits: Blockchain Rails Enter India’s Banking Core

New Delhi, 08 October 2025 — In a bold foray into the future of banking, the Reserve Bank of India (RBI) today launched a controlled [more…]

Sensex Soars 583 Points, Nifty Reclaims 25,000: Bank & IT Stocks Power Festive Rally

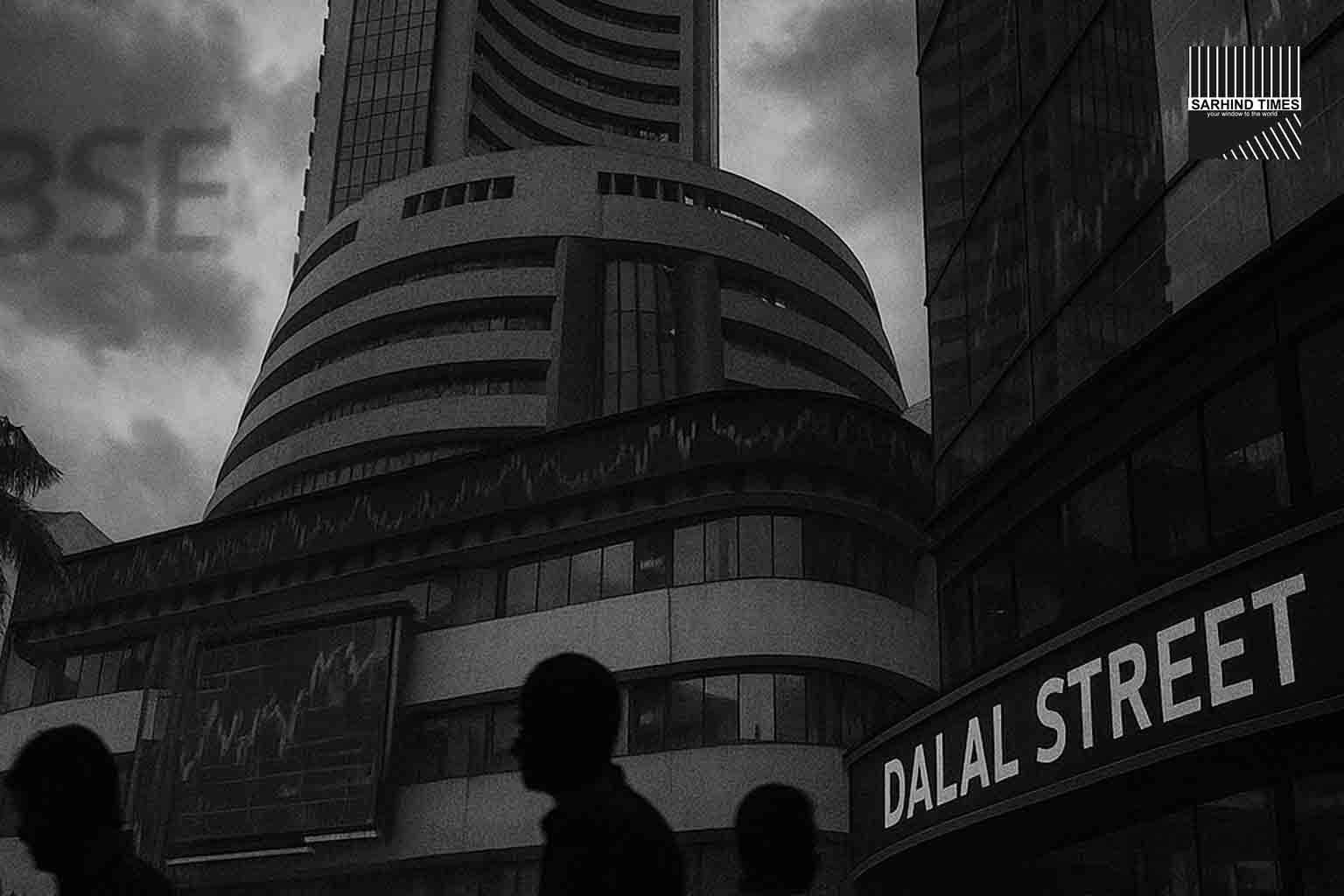

Mumbai, October 7, 2025 | By Sarhind Times Business DeskDalal Street opened the week on a jubilant note as Indian benchmark indices vaulted to fresh [more…]

PhonePe Files for Landmark ₹12,000 Crore IPO in India: A Defining Moment for Fintech and Digital Payments

India’s digital payments story has been one of the great economic transformations of the last decade. At the heart of this revolution stands PhonePe, one [more…]

Sensex, Nifty Extend Losing Streak as Global Jitters Weigh; GIFT Nifty Points to Subdued Open

After a record-breaking rally earlier this quarter, India’s equity markets are showing signs of fatigue. On Wednesday, the Sensex closed at 81,715.63, down 386 points [more…]

RBI Flags Stronger Growth and Consumption in H2 FY25 Amid Global Uncertainty

The Reserve Bank of India (RBI), in its latest communication, has painted a cautiously optimistic picture for the nation’s economic trajectory in the second half [more…]

India PMI Momentum Cools but Remains Strong; Economists Flag Export Softness

India’s private-sector economy is still expanding, but the pace has begun to cool from the blistering highs seen in recent months. Fresh flash PMI (Purchasing [more…]

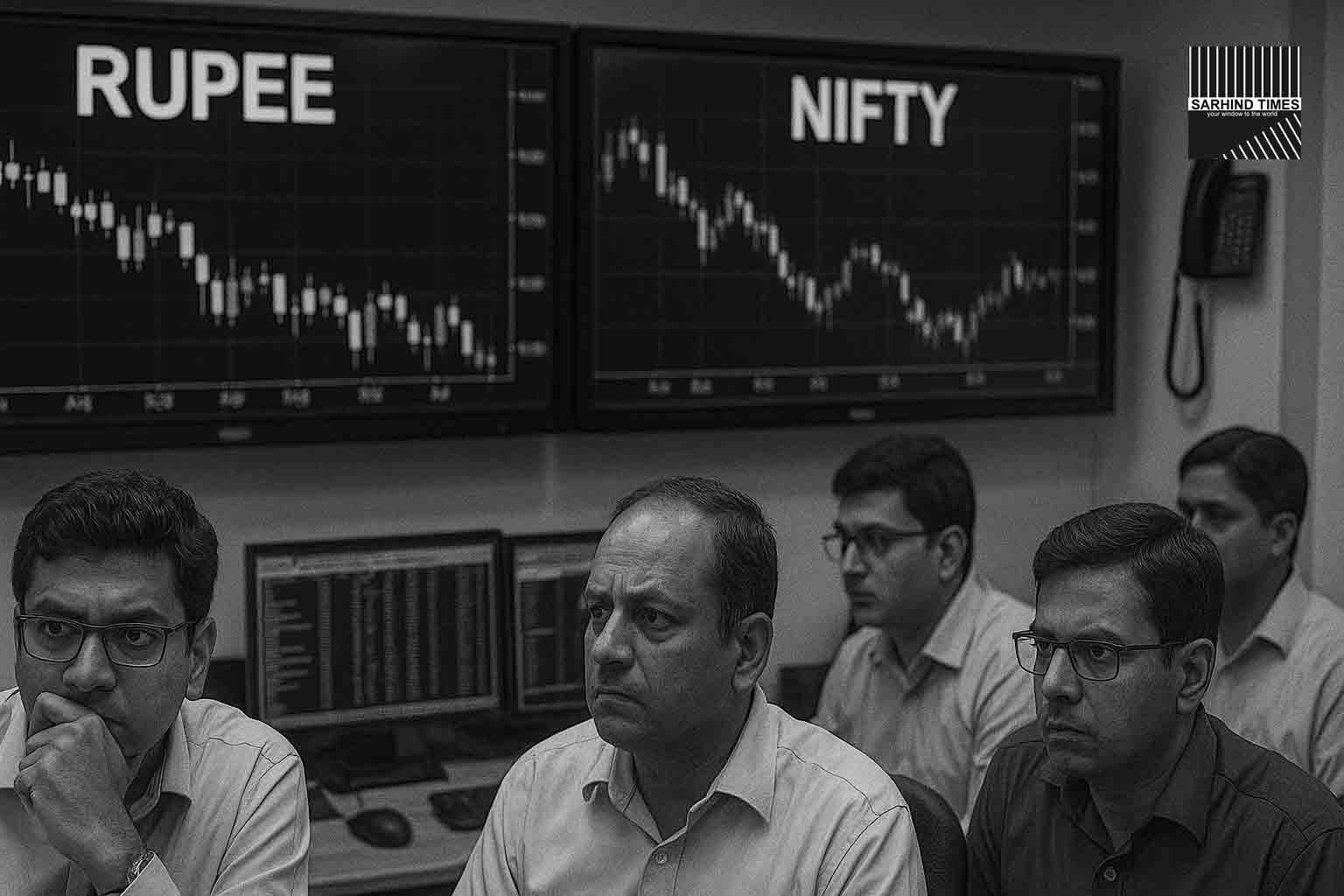

Trade Setup: Cues Mixed as Nifty Eyes Cautious Open; Banks, IT, and Rupee-Sensitive Stocks in Focus

Dalal Street is bracing for a cautious open, with traders closely watching how global risk sentiment, the rupee’s slide, and sectoral churn will shape today’s [more…]

GST 2.0 Kicks In: What Gets Cheaper From Today, and How It Will Impact India’s Economy

22 Sep 2025 A Tax Reset Ahead of Festive Season India entered a new phase of consumption-driven policymaking this morning as the Centre’s revamped GST [more…]

Markets Watch: GIFT Nifty Signals Soft Open as Global Cues Remain Mixed

As Indian traders woke up this morning, market signals suggested a cautious start. The GIFT Nifty, India’s offshore derivative indicator trading in Gujarat’s International Financial [more…]