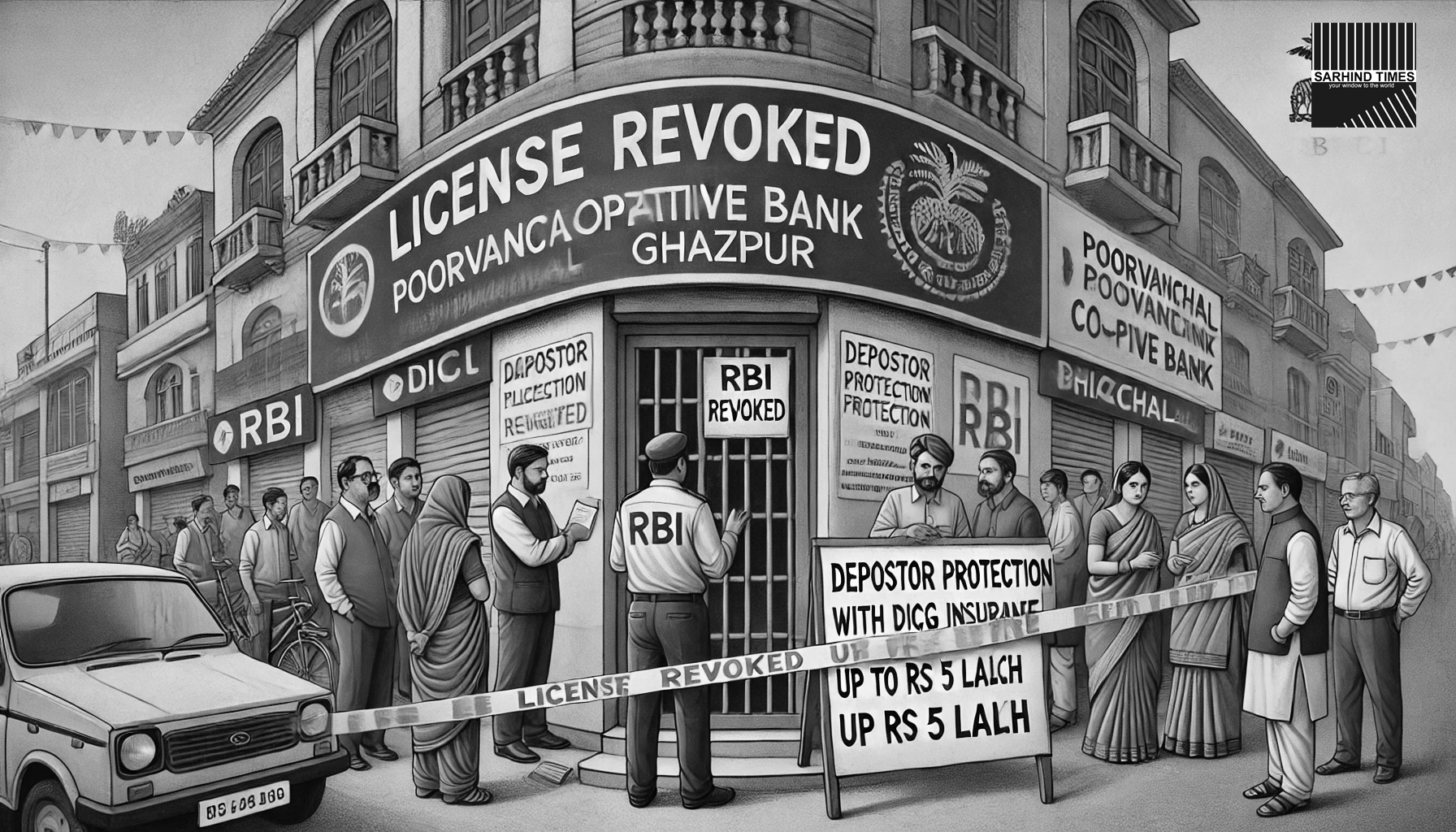

Central Bank Takes Action Due to Inadequate Capital and Earning Potential

Ghazipur, UP — The Reserve Bank of India (RBI) has revoked the license of Poorvanchal Co-operative Bank, located in Ghazipur, Uttar Pradesh. The decision was made due to the bank’s lack of sufficient capital and earning potential. Consequently, the RBI has instructed the Registrar of Co-operative Societies and the Co-operative Commissioner of Uttar Pradesh to shut down the bank and appoint a liquidator.

Details of the License Revocation

Reasons for Cancellation:

The Poorvanchal Co-operative Bank was found to be without adequate capital and lacked future earning potential. According to the RBI, the financial position of the bank was such that it could not pay its present depositors in full.

Regulatory Action:

The RBI has directed the state’s Co-operative Commissioner to close the bank and appoint a liquidator. This step is crucial to protect the interests of the depositors.

Depositor Protection

Insurance Coverage:

Under the liquidation process, each depositor is entitled to receive up to Rs 5 lakh of their deposit amount from the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Depositor Security:

According to the bank’s data, approximately 99.51% of the depositors are expected to get their entire deposit amount back through DICGC insurance.

Impact and Precedent

Current Financial Status:

The RBI emphasized that the co-operative bank, given its current financial condition, would not be able to fulfill its obligations to its depositors. Continuing the bank’s operations would negatively impact public interest.

Historical Context:

The RBI regularly reviews co-operative banks and takes action if significant discrepancies are found. In the past, several co-operative banks have had their licenses revoked due to similar issues.

Key Takeaways

- License Revoked: Poorvanchal Co-operative Bank’s license has been canceled due to inadequate capital and earning potential.

- Depositor Protection: Depositors will receive up to Rs 5 lakh from DICGC.

- Financial Stability: The bank’s financial instability led to the RBI’s decision to protect depositors and public interest.

Detailed Information in Table

| Details | Information |

|---|---|

| Bank | Poorvanchal Co-operative Bank, Ghazipur, UP |

| License Status | Cancelled |

| Reason for Cancellation | Inadequate capital and lack of earning potential |

| Regulatory Action | Closure and appointment of liquidator |

| Depositor Insurance | Up to Rs 5 lakh via DICGC |

| Depositors Eligible for Full Refund | 99.51% |

| Impact on Operations | Unable to pay current depositors, adverse public impact |

For more updates and detailed news, visit Sarhind Times.

+ There are no comments

Add yours