Analysts flag favourable long-term outlook for Indian stocks even as near-term headwinds gather pace

Dateline: New Delhi | 14 November 2025

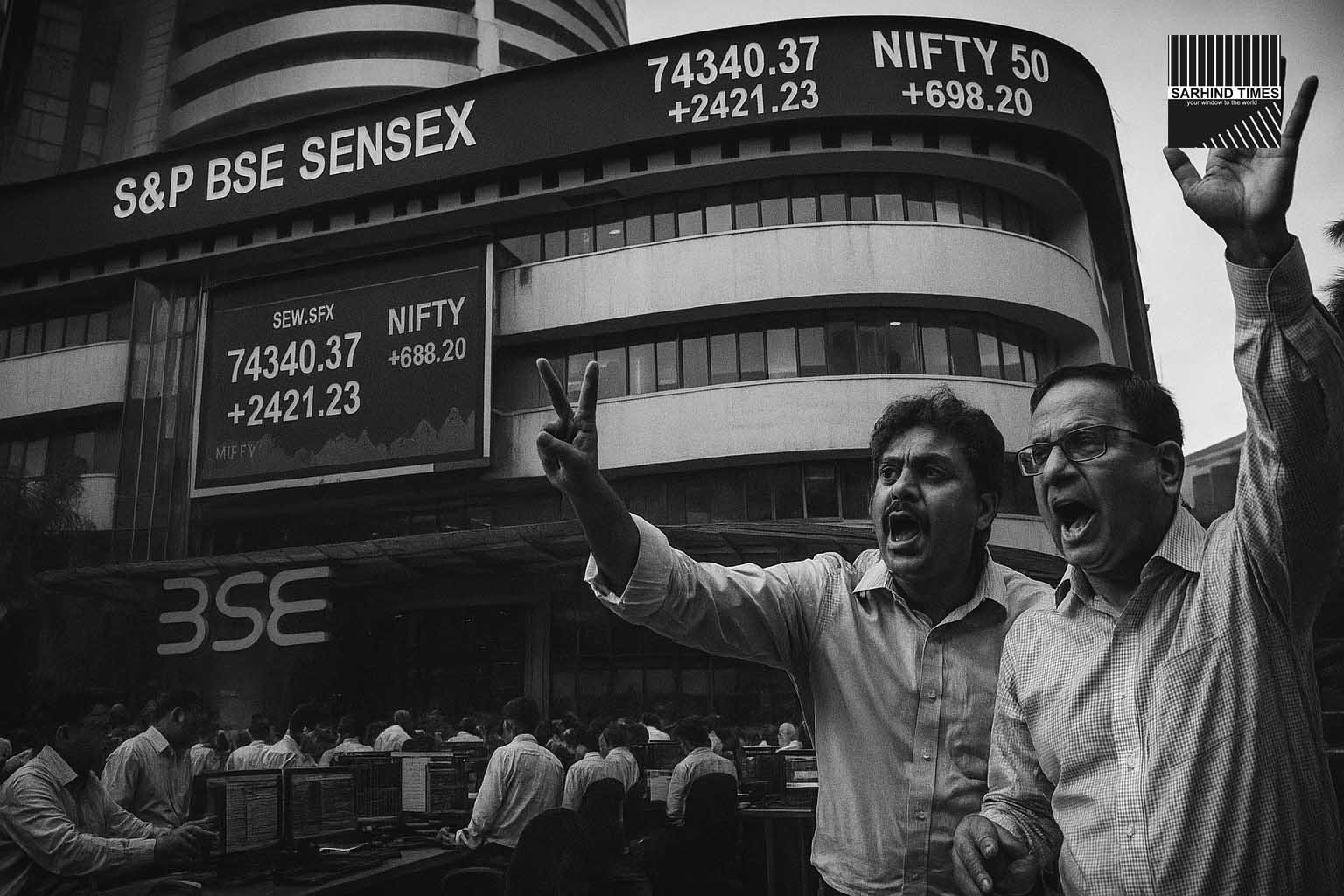

Summary: India’s equity markets are displaying signs of revival—with major indices like the Nifty 50 and BSE Sensex rallying on strong earnings, foreign-inflow interest and positive sectoral breadth. Global bank HSBC has declared Indian stocks an attractive hedge against the global AI-driven rally, while domestic broking houses are optimistic about short-term gains. Yet, caution persists: upcoming state election outcomes, inflation data, global liquidity, and policy continuity remain key watchers for investors.

Market snapshot: Where we stand today

Indian benchmark indices have shown renewed vigour in recent weeks. The Sensex recently climbed to around 84,460 units while the Nifty 50 crossed the 25,875 mark. The rise has been driven by broad-based sector gains including IT, auto and banking. For instance, on 12 November, the Nifty 50 rose approximately 0.7 percent and the Sensex added around 595 points (0.71 percent).

Importantly, institutional markers point to shifting sentiment. Foreign institutional investors (FIIs) ended a three-month selling streak and returned to net buying to the tune of US $1.6 billion in recent weeks—underscoring renewed global interest in Indian equities.

From a technical vantage, domestic analysts argue that the Nifty has now established a base near 25,700-level, with upside potential to 26,300 in the short to medium term.

Why the optimism? Key drivers fuelling the market

Several inter-linked factors are contributing to the bullish sentiment:

- Global diversification logic: HSBC’s global asset-allocation team sees Indian equities as a “hedge” against the world’s AI-stock rally, recommending an “overweight” allocation to India over Chinese equities. They forecast the Sensex touching 94,000 by end-2026 under this thesis.

- Improving corporate earnings: Strong Q2 earnings from major Indian companies such as banking and manufacturing have lifted confidence in corporate India’s growth trajectory.

- Festive demand and consumption momentum: November coincides with India’s largest festive season; improved consumer sentiment and retail activity bolster domestic demand prospects.

- Policy and structural reforms in sight: Importantly, signals of renewed India-US trade dialogue, GST 2.0/rationalisation talk, and PLI (production-linked incentive) roll-outs are contributing to investor optimism.

- Technical breakout and breadth improvement: Analysts note the Nifty breaking a key threshold (~25,750) signals improved internals and breadth, enabling breakout stocks to re-emerge.

Short-term risks and watch-points

Despite the favourable setup, several risks could derail or temper the rally:

Political uncertainty: The upcoming results of key state elections (notably in Bihar) are being watched closely. Market participants interpret election outcomes as signals of policy continuity; caution ahead of results has translated into flat sessions recently.

Global liquidity & inflation: The trajectory of the U.S. Fed’s policy remains a key variable. A hawkish surprise or abrupt tightening could pull capital away from emerging markets including India. Additionally, crude or commodity inflation resurgence could raise cost pressures.

Valuation stretch and participation gap: While large-caps are rallying, mid-cap and small-cap indices remain subdued or lagging, suggesting risk of rotation or narrow rallies inherent in the current move.

Sector-specific fatigue: The IT sector, for instance, which has driven much of the recent momentum, pulled back recently as profit-taking set in.

What sectors are leading — and lagging?

The leadership in this phase appears to be multi-sectoral rather than concentrated:

Leaders:

- IT & tech-exports: Renewed global demand, AI-service opportunities and favourable currency tailwinds are benefiting Indian IT stocks.

- Banking & financials (especially PSU banks): With credit growth stabilising and signs of asset-quality improvement, PSU and private banks are regaining investor attention.

- Auto & consumption: The festive demand, rural recovery and capex cycle expectation support these segments.

- Metals & commodity stocks: Buoyed by global demand and base-effect advantages, metal stocks have shown strength recently.

Laggards or caution zones:

- Mid-cap and small-cap stocks: Their performance has remained lacklustre compared to large-cap. Investors remain wary of higher volatility and illiquidity risk.

- Over-leveraged consumer-facing companies: Despite demand rebound, some peer clusters face margin pressure due to raw-material inflation, making them vulnerable to any demand softening.

Investor strategy: What’s working now

Given the current environment, several strategic insights are emerging:

- “Buy on dips” mindset: With the market having shown strength, analysts suggest using corrections as entry points rather than chasing high valuations aggressively.

- Focus on earnings and structural themes: Prioritise companies with strong earnings visibility, margin discipline, market-leadership and structural tailwinds (exports, AI, rural penetration) rather than speculative bets.

- Watch capital-flows and macro triggers: Keep an eye on FII flows, currency movements (rupee), global interest rates and domestic policy cues—these remain key under-currents.

- Diversify across sectors: While tech and banking are leading, rotation may favour cyclicals (capex, infrastructure) if global growth signals improve. Avoid being overly concentrated in one theme.

- Mid/small-cap caution: Entry into mid and small-cap should be selective, mindful of company fundamentals, liquidity risk and external-shock vulnerability.

Medium-term outlook: What lies ahead

Over the next 12-18 months, the market is likely to be driven by a combination of structural themes and external shock management:

Structural themes to watch:

India’s push for global export competitiveness (in technology, electronics, manufacturing), strong domestic demand (rural + urban, consumption rebound) and policy reforms (PLI, infrastructure spending) provide underlying support for equities.

External buffers:

A stable or weakening U.S. dollar, favourable interest-rate trajectory globally, and improved trade ties (especially with the U.S.) would add to positive momentum. HSBC’s call for Sensex 94,000 by end-2026 reflects this conditional optimism.

Risk calibration:

While the broad market may advance, investors must watch for “valuation resets” if global liquidity tightens, inflation spikes, or earnings disappoint. Sector- and stock-specific differentiation will increasingly matter.

Conclusion: Optimism underpinned by select caution

India’s equity markets have moved beyond a fleeting rebound—they are beginning a phase where structural shifts (exports, AI services, bank reform, domestic consumption) are being priced in. The “buy on dips” narrative makes sense—but only within a framework of disciplined stock-selection, risk awareness and an understanding that macro, global and political triggers remain very much alive.

Investors should view the current rally not as a continuation of past cycles, but a new chapter: one where India is seen as part of the global technology and consumption story, not just a domestic growth story. That repositioning commands higher expectations—and requires higher accountability. In that sense, the opportunity is real—but not without its caveats. Timing, patience, selective exposure and risk management will separate success from disappointment.

`

+ There are no comments

Add yours