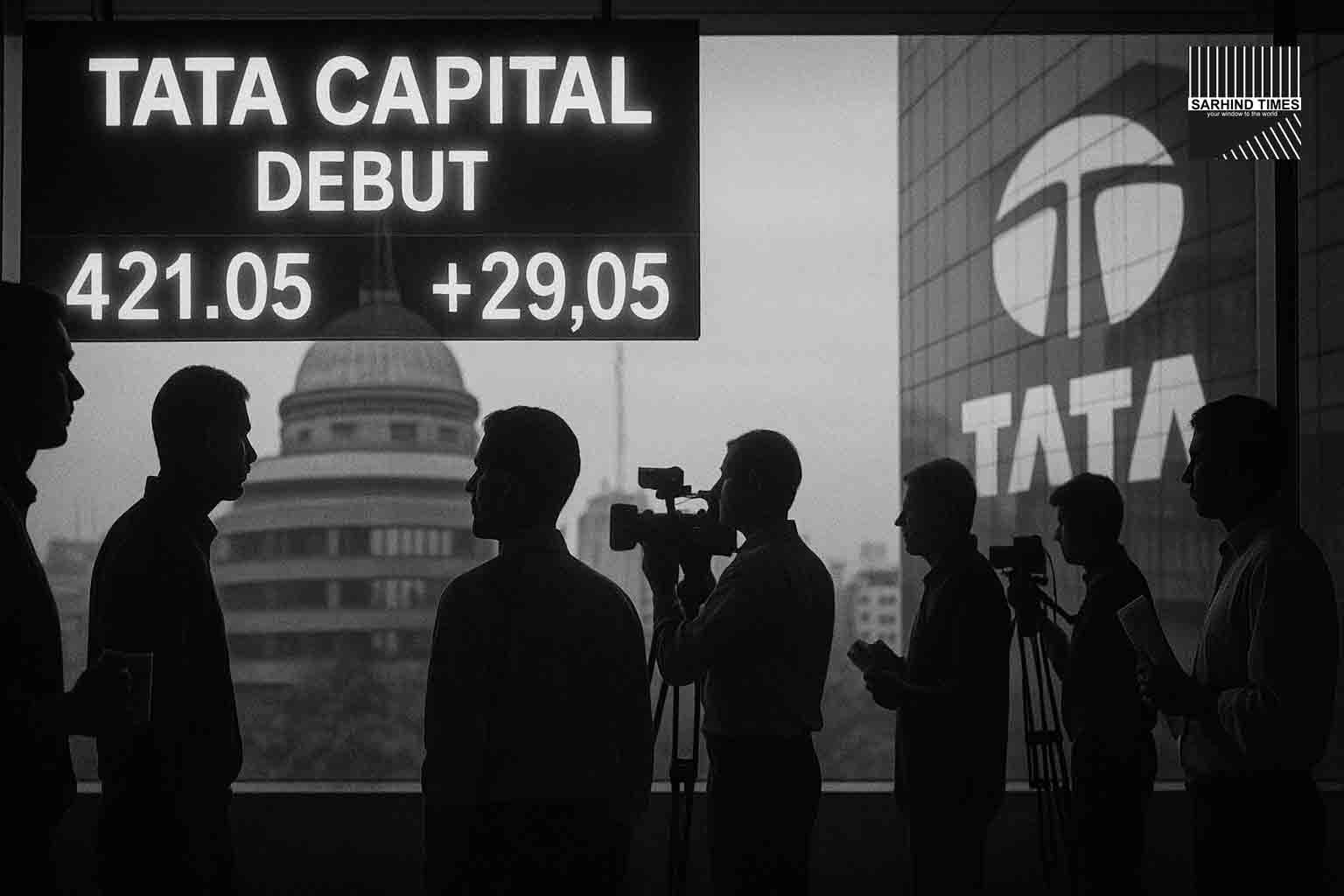

After a record-breaking ₹15,512 crore IPO, Tata Capital lists on the bourses today; investors expect a steady opening near the issue price as focus shifts to fundamentals over frenzy.

Tata Capital’s much-anticipated listing day has arrived, marking one of India’s largest NBFC IPOs in recent years. Despite overwhelming institutional interest and strong brand backing from the Tata Group, the grey market premium (GMP) cooled to near zero before listing, hinting at a measured debut. Market participants see it as a test of India’s IPO appetite and valuation discipline in the face of macroeconomic volatility. Source: The Economic Times.

📈 Mumbai Monday: All Eyes on Dalal Street as Tata Capital Rings the Bell

Mumbai, October 13 —

In what could be one of the most-watched listings of 2025, Tata Capital Limited, the flagship financial services arm of the Tata Group, steps into the public market spotlight today. With its ₹15,512 crore initial public offering now behind it, the company’s market debut on the NSE and BSE is poised to test investor sentiment toward large-cap financial services plays in a maturing bull market.

The listing comes at a time when India’s primary market is bustling with activity — from mid-sized fintech entrants to established conglomerates testing valuations amid evolving macroeconomic headwinds. Yet, for Tata Capital, the moment is historic — not only because of its size but also because it marks a strategic evolution from a closely held Tata entity to a publicly accountable financial powerhouse.

💰 The Offer: A Balance Between Scale and Stability

Tata Capital’s IPO was a carefully crafted mix of a fresh issue of 210 million shares and an offer-for-sale (OFS) of 265.8 million shares, effectively widening its shareholder base and improving liquidity. The issue, priced between ₹310 and ₹326 per share, saw strong demand from institutional investors, with the anchor book oversubscribed multiple times, thanks to participation from LIC, HDFC Mutual Fund, SBI MF, and several global sovereign funds.

Retail investors, however, approached the issue with measured enthusiasm, given its tight valuation band and modest GMP trends. The IPO’s oversubscription ratio stood at 7.8x overall, with the Qualified Institutional Buyers (QIB) segment leading the charge at 11.2x, while retail subscription hovered around 3x.

Market analysts note that the offer’s structure — combining both growth capital and promoter dilution — sends a message of confidence and governance maturity. “This is not a hype-based issue. It’s a fundamentals-driven offering,” said Naveen Jain, Head of Research at Axis Capital. “Investors are evaluating Tata Capital for its franchise strength, diversified lending book, and access to cheap capital due to group credibility.”

🏦 The Business: A Universal NBFC with a Tata Touch

Founded in 2007, Tata Capital operates across a full spectrum of financial services — from consumer loans, SME financing, and housing credit to infrastructure funding and wealth management. The firm’s current asset under management (AUM) stands above ₹1.7 lakh crore, with a net worth of ₹30,500 crore as of Q1FY25.

Its subsidiary, Tata Capital Housing Finance, has emerged as a key driver of growth, especially in affordable and retail housing loans. Meanwhile, Tata Cleantech Capital, a green-finance-focused arm, has gained recognition for renewable energy project funding — aligning with India’s sustainability ambitions.

The company’s robust loan portfolio mix, with less than 2% net NPAs and strong provisioning buffers, makes it one of the most stable NBFCs in its category. In FY24, Tata Capital reported a PAT (Profit After Tax) of ₹4,205 crore, up 22% year-on-year, underscoring operational resilience despite elevated borrowing costs.

🧾 Why This IPO Matters

- Tata Group’s Return to Financial Markets:

After Tata Technologies’ blockbuster listing in 2023, Tata Capital’s IPO cements the group’s financial-services play in the public domain. - NBFC Confidence Barometer:

Following regulatory tightening and rising competition from fintechs, the listing is being viewed as a barometer for investor confidence in traditional NBFCs. - Retail Participation Maturity:

The tempered grey market response reflects growing investor rationality — a shift from speculative listing pops toward long-term fundamentals. - Capital Adequacy Boost:

The fresh issue proceeds will enhance the capital adequacy ratio, supporting business expansion and digital lending initiatives.

📊 The Grey Market Signal: Calm Before the Bell

The Grey Market Premium (GMP) — a key indicator of unofficial trading enthusiasm — fell sharply over the weekend to nearly ₹0–₹5, signaling expectations of a flat or modest listing around the issue price.

Analysts attribute this to three factors:

- Broader market volatility after U.S. rate concerns,

- The IPO’s already fair pricing,

- Investors’ preference for defensive sectors during high valuations.

“Muted GMP doesn’t mean muted confidence,” argues Kavita Desai, an IPO analyst with Motilal Oswal. “This shows maturity — the frenzy is cooling, and quality is being priced rationally.”

📉 A Market Maturing Beyond Listing Pops

For much of the last two years, India’s IPO markets were defined by exuberant retail participation chasing short-term listing gains. The 2025 cycle, however, appears different. From Go Digit General Insurance to Tata Capital, investors are evaluating governance, profitability, and scalability with a longer-term lens.

According to Prime Database, India’s IPO mobilization in 2025 has already surpassed ₹58,000 crore across 42 issues. Yet, average listing-day gains have fallen to 8–10%, compared to 25–30% in 2022. Experts interpret this as a sign of structural maturity rather than fatigue.

“Indian investors are growing up,” says Rachit Bansal, Head of Equity Strategy at JM Financial. “The fact that the GMP is near zero means the market trusts the company’s fundamentals — not speculation.”

📚 The Valuation Debate: Reasonable or Restrained?

At an issue price of ₹326, Tata Capital’s post-listing valuation translates to 3.2x book value and 25x FY24 earnings, aligning with peers like Bajaj Finance (trading at 5x) and Cholamandalam (3.8x).

While some analysts call it a “fair deal” for long-term investors, others view it as fully priced, given near-term pressure on spreads and credit growth moderation. “It’s not cheap, but it’s Tata,” quips Rohit Mehra, fund manager at Quantum AMC. “You’re paying for brand trust, steady governance, and scalability.”

🧮 Inside the Balance Sheet: Quality Over Aggression

Tata Capital’s conservative growth philosophy is visible in its portfolio mix:

- Retail Lending: 45%

- Corporate & Infrastructure: 28%

- Housing Finance: 20%

- Wealth & Others: 7%

Net Interest Margin (NIM) stands at 6.2%, while the Capital Adequacy Ratio is a healthy 21.8%.

The company also boasts a Tier-I capital of 18%, well above regulatory thresholds, enabling strong lending capacity without compromising risk appetite.

Credit rating agencies — CRISIL, ICRA, and CARE — have all reaffirmed their AAA ratings, citing high parentage strength and financial prudence.

🌍 The Global Context: Liquidity in a Tightening World

Tata Capital’s listing comes against a global backdrop of tightening liquidity and elevated interest rates. The U.S. Federal Reserve’s recent comments on “higher for longer” rates triggered minor outflows from emerging markets.

However, India’s financial ecosystem remains resilient. With credit growth at 14.8% and NBFC borrowings declining in cost after RBI’s pause, domestic macro conditions support expansion. Moreover, Tata Capital’s diversified borrowing mix — 65% from market instruments and 35% from bank loans — ensures funding flexibility.

🔍 The Street’s Expectations

Brokerages have issued a range of recommendations:

- ICICI Securities: “Hold for long-term wealth creation.”

- HDFC Securities: “Reasonably priced; stable compounding story.”

- Motilal Oswal: “Attractive governance, moderate growth.”

- Kotak Institutional Equities: “Fairly valued; near-term listing gains limited.”

Analysts expect Tata Capital’s shares to open in the ₹315–₹330 range and consolidate before trending higher as quarterly results validate performance.

📈 Investor Psychology: From Excitement to Evaluation

Retail forums and social media buzz reveal a sense of cautious optimism. Many investors view Tata Capital as a “trust proxy” for India’s formal lending economy. Others are wary of the potential for near-term sideways movement.

“After Tata Technologies’ stellar listing, expectations are naturally high,” says Manish Kapoor, a retail investor from Gurugram. “But even if it lists flat, I’ll hold. It’s Tata — it compounds quietly.”

📊 Institutional Playbook: Long-Term Mandate

Global and domestic institutions are expected to anchor the stock’s stability post-listing.

Long-only funds like Norges Bank Investment Management, BlackRock, and HDFC Life AMC are reportedly among key subscribers. These players typically view Tata Capital as a 3–5-year story centered on India’s credit expansion, formalization, and consumer leverage trends.

🧠 Analysts’ Take: What’s Next for Tata Capital

- Digital Expansion:

The company is set to launch a unified lending app by Q2FY26 to streamline personal and SME loan disbursals. - Geographic Deepening:

Plans to expand to 600+ branches across semi-urban India in the next 18 months. - Green Finance Push:

Tata Cleantech to double its green portfolio to ₹15,000 crore by FY27. - Asset-Light Collaboration:

Strategic partnerships with Tata Neu and BigBasket to push co-lending and BNPL products.

“Tata Capital is positioned to become India’s next full-stack financial institution — comparable in scale to HDFC Ltd within a decade,” predicts Nilesh Suri, Financial Analyst at IIFL Wealth.

⚖️ The Market Mood: Valuation vs Emotion

Listing day excitement often blends logic with legacy — and Tata Capital embodies both. The brand’s legacy commands trust; its valuation demands scrutiny.

Early morning trades will reveal whether investors lean toward faith or fundamentals. Yet either outcome — a flat open or mild premium — reflects confidence in the company’s durable story.

📍 The Verdict: A New Chapter in Tata’s Financial Story

Whatever today’s debut outcome, Tata Capital’s listing symbolizes more than price action — it marks the institutionalization of one of India’s most trusted financial houses. It also reaffirms that India’s IPO market has matured, valuing sustainability over speculation.

The Tata name, once again, has reminded the market that credibility itself is a form of capital.

#TataCapital #IPO #ListingDay #DalalStreet #NBFC #Markets #LIC #StockMarket #TataGroup #Finance #SarhindTimes

+ There are no comments

Add yours