New Delhi, October 4:

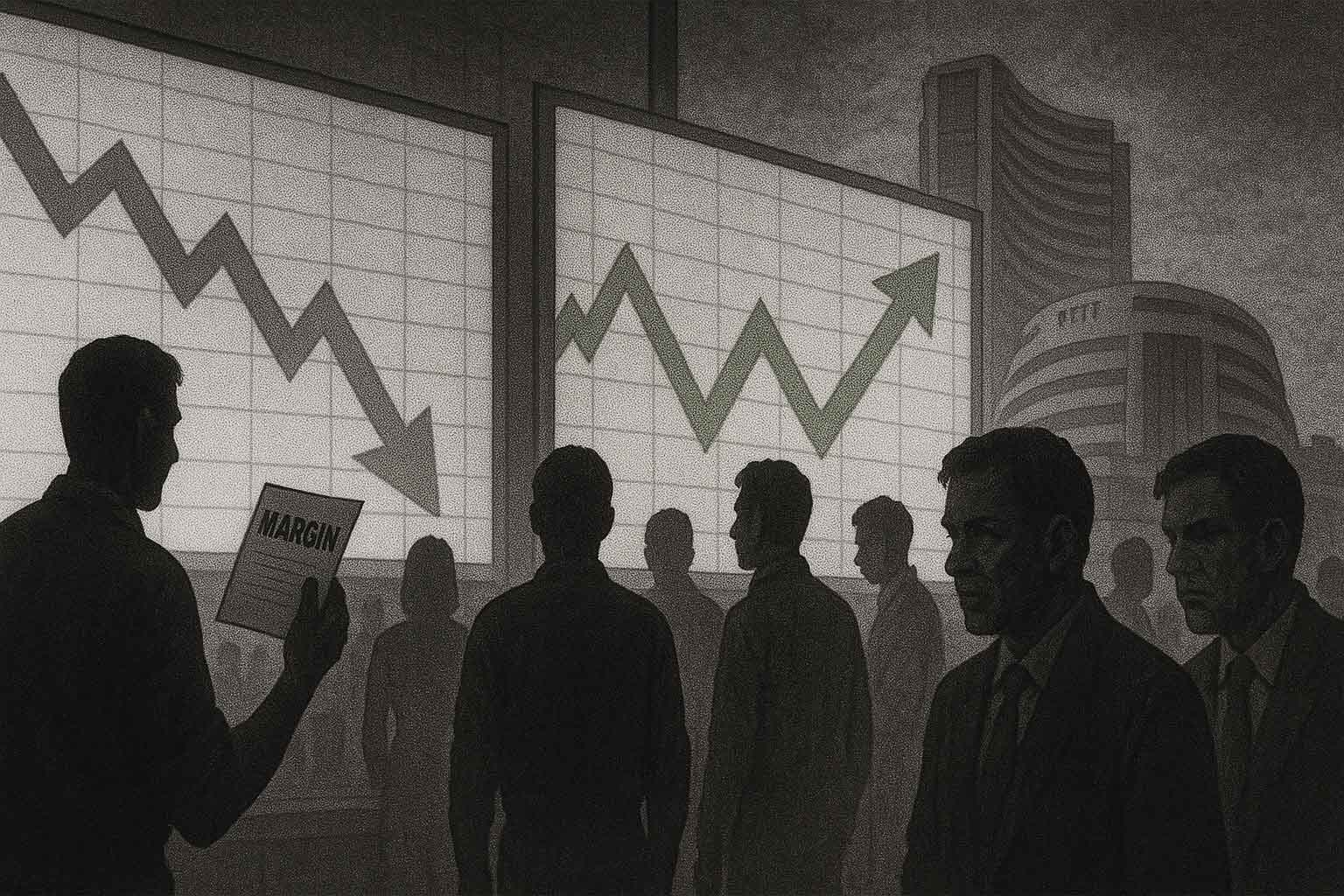

India’s stock markets, basking near record highs, are now witnessing a risky undercurrent: retail investors are increasingly borrowing through margin accounts to scoop up some of the year’s worst-performing blue-chip stocks.

Fresh data from brokerages and exchange disclosures suggest margin borrowing has spiked sharply in recent weeks, driven by small investors who view “laggards” as bargain opportunities. While optimism is understandable amid strong festive liquidity, experts warn that leveraged bets on underperformers could amplify risks if volatility strikes.

This trend is reshaping conversations across Dalal Street, reviving age-old debates about risk management, investor education, and regulatory safeguards.

Understanding Margin Trading

Margin trading allows investors to borrow money from brokers to purchase shares, using their portfolio as collateral. In rising markets, it magnifies gains. In falling markets, it magnifies losses.

- Blue-chip laggards: Well-established companies, but currently trading at lower valuations due to weak earnings or regulatory challenges.

- Retail risk appetite: Small investors, drawn by lower entry prices, often underestimate the downside of leverage.

- Systemic concern: Sudden deleveraging can trigger sharp sell-offs, impacting broader indices.

The Recent Spike

According to market data, margin balances at brokerages have risen 15–20% in the last quarter, coinciding with a broader recovery in indices. Analysts say:

- Sectors targeted: Energy, telecom, and pharma—areas that lagged in FY25 due to regulatory or demand issues.

- Investor profile: Mostly new-age investors using app-based brokers.

- Festive optimism: Expectations of consumption-driven earnings recovery embolden dip buyers.

Expert Warnings

Brokers and analysts have sounded caution:

“Buying laggards on margin is like driving on a highway without brakes. Cheap stocks can get cheaper, and leverage makes recovery harder,” said Ashish Mehra, a Mumbai-based trader-educator.

Regulators too are monitoring. SEBI recently emphasized the need for disclosure of leverage risks and may tighten suitability checks for first-time margin users.

Why Retail is Taking This Path

- High market levels: With Nifty and Sensex near peaks, laggards look “affordable.”

- Social media hype: Stock tips and forums glorify “bottom fishing.”

- Liquidity: Broker apps make margin borrowing seamless.

- Psychology: FOMO (fear of missing out) drives small investors to chase perceived bargains.

Historical Lessons

India’s past cycles show how excessive retail leverage ended painfully:

- 2008 crash: Margin calls triggered forced selling, worsening declines.

- 2020 pandemic: Leverage spiked during initial rebound, leading to wipeouts when volatility hit.

The latest surge raises fears of history repeating if macro conditions sour.

The Other Side: Opportunity

Not all experts are dismissive. Some argue disciplined margin use can be strategic:

- Buying undervalued but fundamentally strong blue-chips.

- Staggering entries to manage volatility.

- Hedging via options to reduce risk.

If India’s growth story sustains, today’s laggards could be tomorrow’s leaders—though timing remains critical.

Investor Education Gap

A bigger issue is the lack of financial literacy. Market educators say most retail investors don’t fully understand terms like “mark-to-market margin” or “margin call.” Without clear awareness, many risk losing not just profits but their principal.

“Education is the missing piece. Retail participation is welcome, but it must be informed,” noted Prof. R. Subramanian of IIM Bangalore.

The Regulatory Lens

- Suitability checks: SEBI may mandate risk profiling before allowing leverage.

- Leverage caps: Discussions on reducing the maximum margin available for new investors.

- Disclosure norms: Brokers could be required to highlight margin risks prominently in mobile apps.

Broader Impact

- On markets: Forced deleveraging could amplify index volatility.

- On economy: Retail wealth erosion impacts consumption trends.

- On politics: Policymakers face pressure to show markets are “safe for common investors.”

Conclusion

Retail enthusiasm is a sign of India’s maturing capital markets. But excessive leverage, particularly on underperforming stocks, can quickly turn enthusiasm into crisis. As India balances democratized market access with systemic stability, the coming months will reveal whether this retail “risk-on” story ends as a success—or as another cautionary tale.

#StockMarket #RetailInvestors #MarginTrading #BlueChips #RiskManagement #DalalStreet #Investing

+ There are no comments

Add yours