New Delhi, October 4:

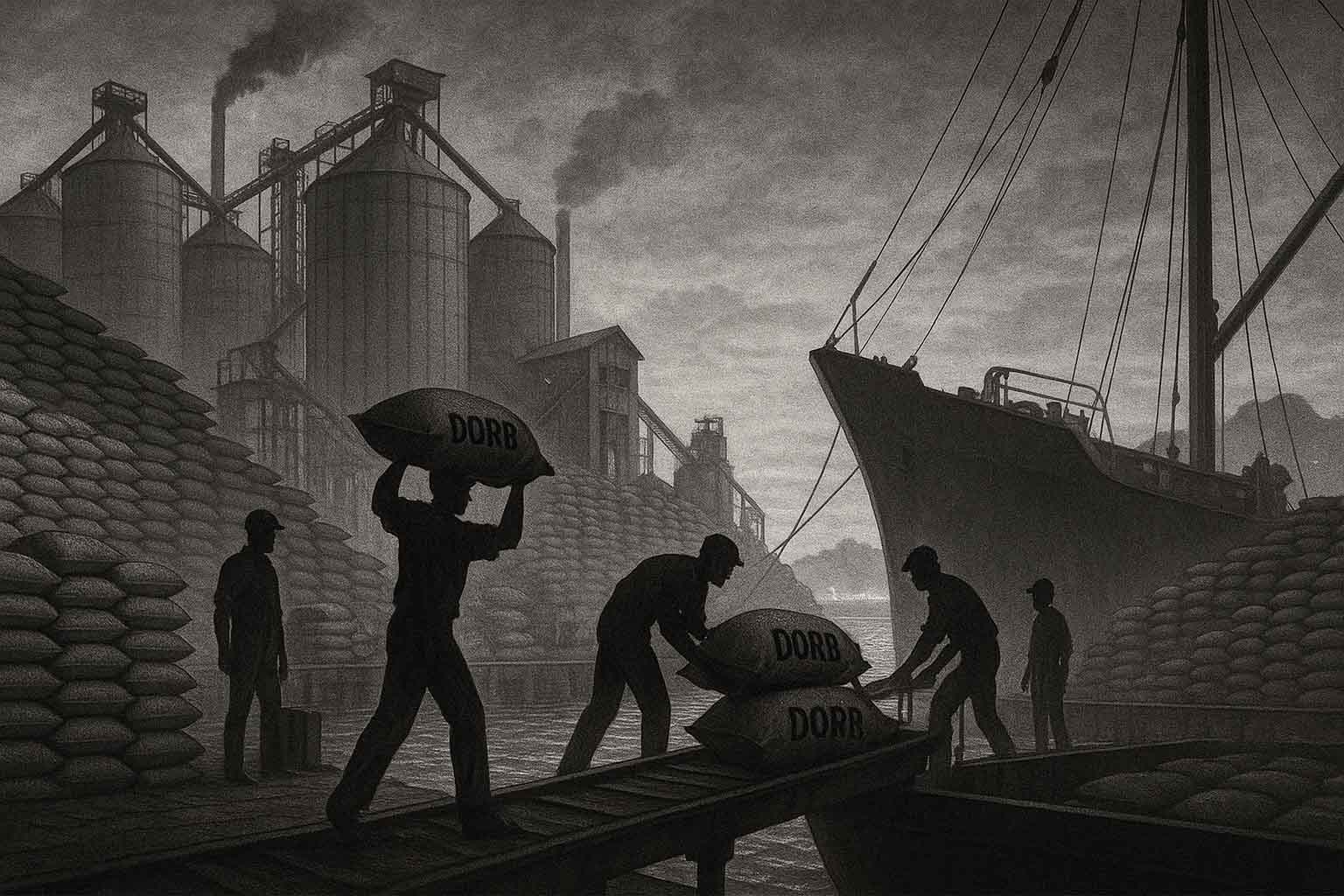

In a major boost to India’s agri-processing and feed industries, the Union government has lifted the ban on exports of de-oiled rice bran (DORB), a critical by-product of rice milling used globally in animal feed and aquaculture. The move, industry insiders say, will unlock overseas demand, stabilize domestic inventories, and provide much-needed relief to rice mills that have struggled with excess stock.

The announcement comes at a time when India is carefully recalibrating its trade policies to balance farmer interests, inflation control, and export opportunities. Unlike rice or wheat—which are politically sensitive staples—DORB falls into a relatively safer category, making the decision more market-driven than populist.

What is De-Oiled Rice Bran (DORB)?

DORB is produced after extracting oil from rice bran, the outer layer of the rice grain. Once the oil is removed, the leftover bran meal is rich in protein and fiber, making it an excellent ingredient for:

- Cattle feed

- Poultry feed

- Aquaculture diets

India, being the world’s second-largest rice producer, generates millions of tonnes of bran annually, ensuring abundant supply of DORB. Until recently, much of this was consumed domestically, but global demand has been steadily rising.

Why Was the Ban Imposed?

The government initially restricted DORB exports in late 2023 amid fears that excess overseas shipments could push up feed costs domestically, indirectly raising prices for dairy and poultry products. Policymakers also worried that global demand spikes could leave Indian farmers vulnerable.

However, ground realities showed otherwise:

- Domestic surplus: Rice mills faced bulging inventories.

- Low inflation impact: Since DORB is not directly consumed by humans, its role in food inflation was limited.

- Export demand: Buyers in Southeast Asia and the Middle East kept seeking supplies from India.

Why Lifting the Ban Matters Now

- Relief for Rice Mills – Mills will be able to monetize stockpiles, improving cash flow ahead of peak paddy procurement season.

- Support for Farmers – Stable demand ensures better prices for bran, indirectly benefiting paddy farmers.

- Boost to Exports – India can capture market share in feed-deficient countries.

- Trade Balance – Even marginal agri-exports add to forex inflows, aiding India’s export basket diversification.

Industry Reactions

Exporters:

“Overseas demand is strong, particularly from Vietnam, Thailand, and Bangladesh. This decision brings clarity and confidence for forward contracts,” said Rajesh Gupta, a leading DORB exporter from Punjab.

Rice Millers:

“This is a relief. Without exports, mills were sitting on unsold stock. The timing is perfect before the new harvest,” added Sunil Kumar, who runs a milling unit in Haryana.

Policy Analysts:

Experts view the move as pragmatic. “The government is walking a fine line between protecting domestic food security and supporting agri-trade. In this case, exports don’t compromise consumer inflation, so the green signal makes sense,” said Dr. Kavita Rao, senior economist at NIPFP.

Global Context

India competes with Thailand, Vietnam, and Indonesia in supplying DORB to the global market. With feed demand rising in aquaculture-driven economies, India’s decision to resume exports could improve its share significantly.

- Vietnam: Needs DORB for its fish farming industry.

- Bangladesh: Relies on imports for cattle and poultry feed.

- Middle East: Expanding livestock sectors are increasingly turning to India for feed ingredients.

Challenges Ahead

While the policy shift is welcome, stakeholders point out hurdles:

- Logistics Costs: Freight and container shortages could blunt competitiveness.

- Currency Volatility: A weaker rupee may help exporters, but long-term stability matters.

- Procedural Clarity: Exporters want quick guidelines on documentation to avoid delays.

Impact on Farmers

Indirectly, paddy farmers gain the most. A stronger demand for bran (a milling by-product) improves mill margins, enabling them to pay better procurement rates. In rural belts across Punjab, Haryana, Uttar Pradesh, and Odisha, the announcement has been greeted positively.

Farmer unions noted that ancillary income from bran often determines whether smaller mills can keep procurement steady.

Policy Balancing Act

India has faced criticism in the past for abrupt trade bans—especially in rice and wheat—that disrupted global markets. By selectively easing DORB exports, New Delhi is signaling a more calibrated approach: controlling direct staples while freeing up feed-related by-products.

This nuanced strategy could improve India’s credibility as a reliable agri-exporter.

Economic Implications

- Export Earnings: Even if modest, DORB exports add diversity to India’s agricultural export basket.

- Rural Employment: Healthier rice mills mean more stable jobs in semi-urban and rural districts.

- Inflation Shield: Since DORB isn’t a household staple, its export won’t hurt household budgets.

Political & Social Context

Ahead of state elections, the move may resonate with farmer communities, especially in Punjab and Haryana. With rising concerns about farm income, the Centre can project this as a pro-farmer, pro-industry reform.

Socially, it also sends a signal that India is committed to supporting secondary industries in agriculture, not just primary crop production.

Conclusion

The lifting of the ban on de-oiled rice bran exports is more than just a technical policy change—it is a strategic decision blending economics, diplomacy, and domestic politics. By addressing farmer welfare, industry viability, and global demand simultaneously, the government has attempted to strike a rare balance.

If execution is smooth, DORB exports could become a case study in how secondary agricultural by-products can fuel trade growth without disrupting domestic food security.

#Agriculture #TradePolicy #Exports #RiceBran #FarmEconomy #Feeds #IndiaEconomy #GlobalMarkets

+ There are no comments

Add yours