By Sarhind Times Investigations Desk | Hyderabad/New Delhi | October 2, 2025

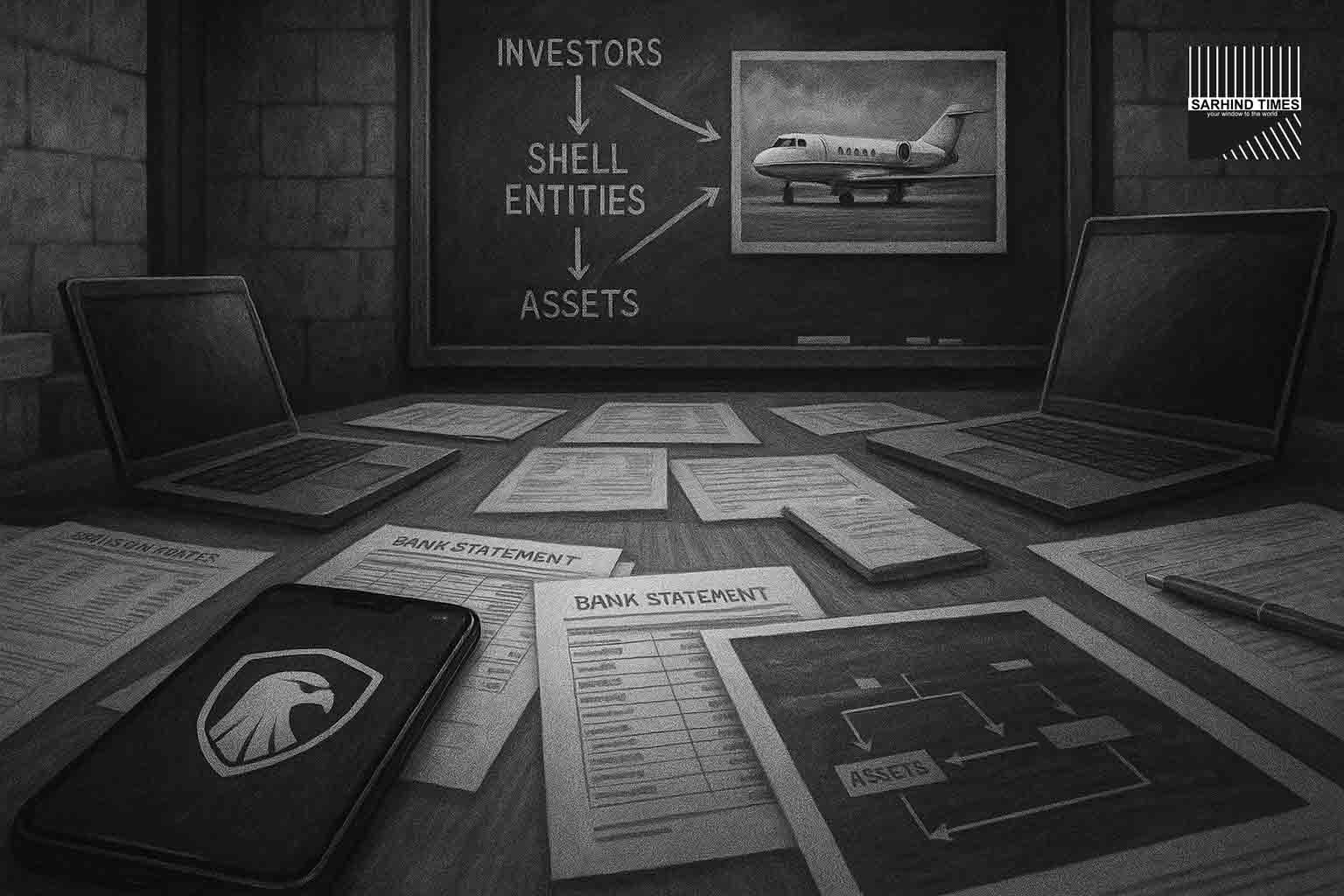

HYDERABAD: The Enforcement Directorate has filed a prosecution complaint under the Prevention of Money Laundering Act (PMLA) in the so-called “Falcon” case—an alleged Ponzi-style operation that pitched itself as an invoice-discounting platform but, investigators say, siphoned investor money into luxury assets, real estate and high-roller spends. The complaint, placed before the special PMLA court in Hyderabad, follows months of arrests, attachments and a headline-grabbing seizure: a Hawker 800A private jet acquired with investor funds.

According to filings and reportage, the Falcon scheme—promoted through Capital Protection Force Pvt Ltd and a mobile app—raised thousands of crores over short tenures by promising assured returns of 11–22%, fabricating links to blue-chip companies to project legitimacy. While the confirmed loss has been tallied at roughly ₹792 crore, investigators and state-level probes have cited much larger gross collections before the scheme collapsed earlier this year.

The Case, at a Glance

- What’s filed: ED prosecution complaint (chargesheet) under PMLA against the company and key actors in the “Falcon” ecosystem.

- Alleged modus operandi: A fake invoice-discounting front (Falcon app) collected deposits with assured returns, then layered and diverted funds.

- Scale & losses: Reports vary—collections cited from ₹1,700 crore to ₹4,215 crore; confirmed losses around ₹792 crore.

- Seizures/attachments: Private jet (Hawker 800A) seized; properties attached worth ~₹18 crore; luxury assets, equities, casino spends flagged.

- Arrests so far: Multiple, including the COO Aryan Singh, an auditor, and other operatives; the alleged mastermind Amardeep Kumar is a central figure in ED’s narrative.

Inside the “Falcon” Pitch: How The Money Came In

Investigators say Falcon’s pitch exploited the opaque, jargon-heavy world of invoice discounting. The app purported to pool investor money to fund short-term receivables of reputed companies—an activity that, when genuine, can earn double-digit annualised yields with actual invoices and verified counterparties. In Falcon’s telling, investors could earn 11–22% quickly by backing these deals.

But the ED’s probe—and earlier CID work—describe a very different reality: no genuine invoice-discounting activity; fabricated claims of corporate tie-ups; relentless digital marketing and referral-driven growth; and rapid cross-account fund movements consistent with layering rather than lending. The allure of assured returns did the rest.

Where the Money Went: Jet, Properties, Equities—and Casinos

The complaint references a now-seized Hawker 800A jet reportedly acquired for roughly $1.6 million and domestic properties; reportage also notes diversions to casino spends, equity purchases, and loans to related or shell entities—classic markers of proceeds-of-crime dispersal that PMLA seeks to trace and freeze. The ED has also listed immovable properties (≈₹18 crore) under attachment orders, with more trace-and-attach action likely as bank, wallet and device forensics lead to additional trails.

The Arrest Trail: COO, Auditor, Operatives

Over recent weeks, the Hyderabad Zonal Office has arrested Aryan Singh, Falcon’s COO, and other accused including a chartered accountant linked to the financial architecture of the scheme. Earlier, Sandeep Kumar—associated with operations and related entities—was also taken into custody. Each arrest has added devices, chats, and ledgers to the evidence basket that now sits inside the prosecution complaint.

The alleged mastermind, Amardeep Kumar, is repeatedly named in enforcement materials as the architect of the app and scheme narrative. CID and ED timelines describe a familiar arc: aggressive growth, stress fractures when redemptions outpace inflows, and finally a scramble that leaves thousands of depositors exposed.

What Exactly Is a “Prosecution Complaint” Under PMLA?

Under the Prevention of Money Laundering Act, 2002, the ED files a prosecution complaint—functionally akin to a chargesheet—before a Special Court (PMLA). It lays out the proceeds-of-crime, the laundering acts (placement, layering, integration), and the roles of accused persons. The Special Court then takes cognizance and the matter proceeds to trial. The complaint often runs into tens of thousands of pages in complex financial-crime cases, bundling bank trails, KYC, device forensics, email/chat dumps, and statements. (Media reports today do not specify an exact page count for Falcon.)

The Numbers: Why Different Outlets Cite Different Totals

- Investor losses (~₹792 crore): A figure frequently cited across ED actions and CID communications—broadly the net unrecovered loss.

- Gross collections (₹1,700–₹4,215 crore): Reflect either total inflows or exposure before repayments; some reportage cites ≈₹1,700 crore, others ≈₹4,215 crore tied to 7,056 investors.

Such variance is typical in early enforcement cycles: numbers evolve as agencies reconcile banking records, UPI/wallet transfers, and cash components with claims from victim lists.

The Playbook: How “Assured Returns” Packages Morph Into PMLA Cases

Ponzi-style raises typically show three common tracks, all visible here:

- False premise (invoice discounting with big brands) to create credibility.

- Guaranteed returns over very short tenures, designed to snowball via referrals.

- Layering into assets, equities, casinos, and related parties once the pool is large—and a collapse when redemptions swamp fresh inflows.

When CIDs/EOWs register predicate-offence FIRs under IPC/BNS and state laws, the ED hooks the case under PMLA to trace, freeze, and attach assets deemed to be proceeds of crime, and then prosecutes the laundering acts before the Special Court.

What the ED Has Already Done—and What Comes Next

- Seizure & attachment: The Hawker 800A and ₹18-crore worth of properties are already under seizure/attachment. More could follow as foreign wallet trails (if any), equities, and benami holdings are forensically mapped.

- Custodial interrogation: Interrogations of the COO and other operatives have fed the ED’s complaint with transaction maps and digital evidence.

- Cognizance & trial: Once the Special Court takes cognizance, the matter moves toward charges framing, evidence-led trial, and restitution workstreams that often run in parallel via attachment confirmations and disposal.

Investors, Beware: Five Red Flags This Case Re-Teaches

- “Assured returns” + “short tenures” in a product you can’t independently verify.

- No verifiable counterparties—if the platform claims big-brand invoices, you should be able to trace invoice IDs or secure a third-party verification.

- Aggressive digital marketing and referral bonuses tied to FOMO-heavy messaging.

- Opaque custody of funds—if your money instantly splits into multiple accounts, that’s layering.

- Hard-to-reach promoters and moving goalposts on redemptions; early warnings often hide in changed terms & conditions.

The Human Ledger: Who Lost, and How Much?

CID material and media reports point to thousands of victims, cutting across IT professionals, traders, retirees and small business owners. The scheme’s framing—“invoice discounting” is both familiar and esoteric—meant it did not “look” like a crypto or meme-coin fling; it wore the costume of supply-chain finance, a legitimate space whose brand halo can be misused. The depth of harm—lost savings, debt for redemptions, fractured families—rarely shows up in numbers.

Why “Invoice Discounting” Was an Easy Mask

Real invoice discounting runs through NBFCs/fintechs with registered counterparties, escrowed cash flows, and a paper trail. Falcon’s reconstruction suggests: no real invoices, no genuine anchors, and no escrow discipline—only a story. Regulators have spent the last five years drafting platform and aggregator rules to reduce such arbitrage, but shady operators still slip through by relabeling Ponzi mechanics as “fintech innovation.” The result is reputational collateral damage for legitimate players.

Policy Angle: The Case for Quicker Redress & Platform Hygiene

The Falcon file lands as India continues to tighten platform hygiene—from KYC and VDA (virtual digital asset) reporting to AML playbooks for payment intermediaries. Two policy priorities stand out:

- Fast-track attachment confirmation: Speed lowers dissipation risk and improves victim recovery odds.

- Disclosure standards for “invoice platforms”: Public registries of anchors, escrow banks, live invoice IDs, and audit trails—so bogus claims can be challenged in days, not months.

A Note on Crypto: The “Falcon” Case Isn’t a Coin Scam—But The Lessons Transfer

Despite social-media shorthand calling it a “crypto” scam, Falcon is fundamentally an invoice-discounting façade; where crypto enters is in layering & movement of funds across exchanges and wallets—an increasingly common laundering route. India’s enforcement agencies have, in other cases this year, attached assets linked to VDA-based frauds and filed high-profile chargesheets that emphasize on-chain tracing combined with traditional bank forensics. The larger takeaway for investors: do not conflate DLT buzzwords with actual counterparty risk.

Timelines & Milestones (Cut-Out Box)

- Jun–Aug 2025: CID/ED arrests including Sandeep Kumar and Aryan Singh; ED attaches ₹18-crore properties; Hawker 800A seized.

- Sep 2025: Additional arrests; audit and device forensics deepen.

- Oct 2, 2025: ED prosecution complaint filed before Special Court (PMLA), Hyderabad.

What Happens Next—For Victims and Accused

- For victims: Attachment orders are a path, not a destination. Adjudicating Authority confirmation and eventual disposal are key to recovery; keep documentation ready and follow ED/CID victim-registration processes.

- For accused: The Special Court’s cognizance triggers the criminal trial. Bail, plea, and cooperation decisions will shape timelines, as will any effort to settle or restitute through parallel civil processes (where permissible).

- For the market: Expect renewed scrutiny of alternative credit platforms and more disclosures demanded by investors, RWAs and HNIs before committing capital.

Why This Case Will Echo

Falcon sits at the intersection of fintech mimicry and old-school Ponzi mechanics. It borrowed regulatory vocabulary (invoice discounting), harnessed mobile acquisition, and then ran classic layering. The ED’s complaint, combined with seizures and arrests, puts consequences behind the headlines. If the Special Court’s process runs swiftly—and attachment confirmations hold—this could become a template case for deterring look-alike platforms.

“We’ll Believe the Numbers We Can Audit”

The biggest critique of fraudulent invoice platforms is simple: show the invoices. Which anchor? Which payable? Which escrow? Which TReDS or NBFC partner? In legitimate ecosystems, these are auditable facts. In Falcon’s reconstruction, they appear as marketing claims—and that is where the law is now drawing a bright line.

#ED #CryptoScam #FinancialCrime #FalconCase #MoneyLaundering #InvoiceDiscounting #Hyderabad #PMLA #InvestorAlert #India

+ There are no comments

Add yours