New Delhi, October 1 –

India’s retail engine, long buoyed by festive anticipation and GST stability narratives, recorded an unexpected dip in the second quarter of FY2025. Industry trackers report that FMCG and electronics categories shrank by 5–25% in sales volume, even as optimism around GST implementation created a positive sentiment at the policy level.

The irony of the season is striking: while GST was meant to unify markets and reduce consumer confusion, buyers are delaying big-ticket purchases—waiting for clarity on revised slabs, festive discounts, and post-implementation price stability.

The Numbers: A Mixed Quarter

- FMCG sector: Down by 5–10%, especially in discretionary items like premium packaged foods and personal care.

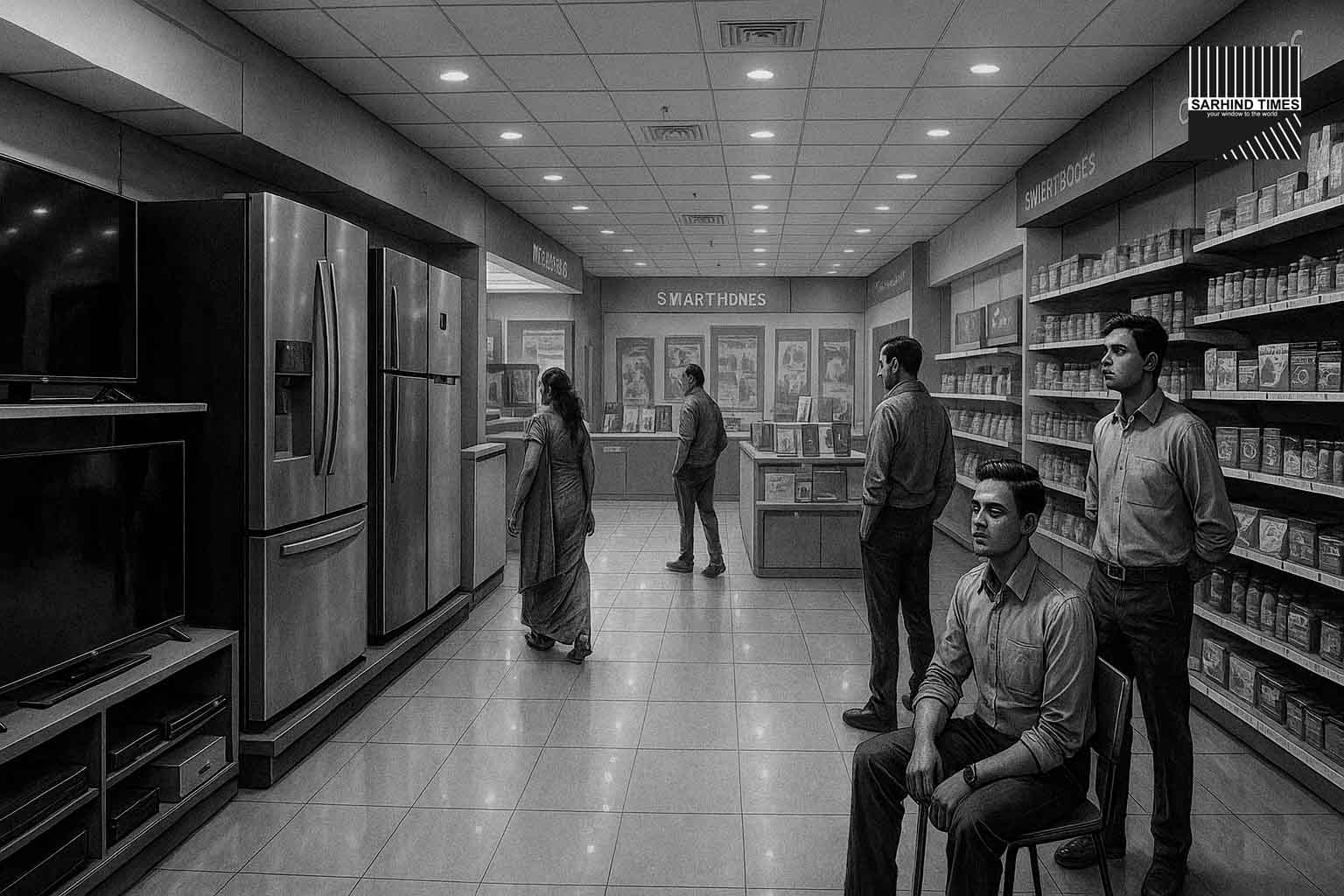

- Electronics: Fell sharply by 15–25%, particularly in high-value items such as refrigerators, washing machines, and premium smartphones.

- Rural vs Urban: Rural demand held relatively steady for essentials, but urban discretionary spending slowed.

Why the Dip Happened

Analysts point to a convergence of factors:

- GST Transition Confusion: Consumers expect possible adjustments in GST slabs for electronics and premium FMCG items, prompting them to wait.

- Festive Timing: With Navratri and Diwali around the corner, buyers are deferring purchases for seasonal discounts.

- Inflationary Stress: Food and fuel costs have dented disposable incomes, particularly for urban middle classes.

- Credit Behavior: Retailers report slower conversion on EMI-based purchases, as buyers adopt a “wait-and-watch” stance.

Retailers Speak

- Electronics chain manager (Delhi): “We have footfall, but people come to check prices and leave, saying they’ll decide post-Dussehra.”

- FMCG distributor (Ahmedabad): “Volume growth is sluggish. Essentials move, but premium categories are stuck.”

- E-commerce platform executive: “Pre-festive slowdown is real, but we expect pent-up demand in October.”

The GST Optimism Factor

Despite the slowdown, optimism remains high:

- Clarity Ahead: Once revised GST slabs are announced, buyers may feel reassured.

- Logistics Gains: For retailers, GST has streamlined interstate movement and reduced warehousing costs.

- Pricing Stability: Manufacturers are expected to pass on efficiency savings to consumers in Q3.

Sector-Wise Impact

FMCG:

- Premium biscuits, chocolates, and personal care items saw sharper drops than staples like flour and oil.

- Urban retail chains bore the brunt; rural demand held steady for everyday goods.

Electronics:

- Premium smartphones: down ~20%.

- Consumer durables (ACs, washing machines): down ~15–25%.

- Laptops/Tablets: demand weak, but gaming segment showed resilience.

Festive Quarter Outlook

- Pent-Up Demand: Delayed purchases are likely to unlock in October.

- Discount War: Retailers plan aggressive promotions to clear Q2 inventories.

- GST Clarity: Expected revisions in slabs could reduce sticker shock.

- Digital Push: E-commerce platforms are betting on bundled finance schemes.

Consumer Sentiment

- Middle-Class Buyer: “I’ll wait until Diwali. Prices may drop, and I don’t want to regret buying early.”

- Young Professional: “GST makes things simpler, but I need clarity on whether my laptop will get cheaper post-revision.”

- Housewife in Lucknow: “Essentials we still buy. But cosmetics and extra snacks, we cut down.”

Industry Experts

- Retail Economist: “The dip is temporary. Post-GST clarity and festive spending will correct the trend.”

- Market Analyst: “Electronics will bounce first, FMCG will take longer as inflation pinches everyday consumption.”

Macro Impact: A Cautionary Signal

India’s retail slowdown is not just a quarterly blip—it highlights:

- Price sensitivity in urban consumption.

- Dependence on festive demand as a structural driver.

- Vulnerability of discretionary FMCG compared to essentials.

If Q3 does not rebound strongly, manufacturers may face inventory pile-ups and pressure on margins.

Global Context

Internationally, India’s retail story mirrors other economies where consumers delay discretionary purchases amid policy transitions. But the sheer size of India’s festive economy means October–November could reverse Q2 losses completely.

Conclusion: Pause Before the Festive Sprint

Q2’s 5–25% dip in FMCG and electronics signals a pause in India’s retail growth story, but not a collapse. With GST optimism intact and festive triggers approaching, the slowdown is likely a temporary lull before the surge.

Dealers, distributors, and e-commerce giants are already gearing up for a record-breaking October. The only question: will the delayed demand fully compensate for the Q2 slide?

#RetailPulse #FMCG #Electronics #GST #FestiveSeason #ConsumerTrends #IndiaEconomy #Inflation #BigTicketPurchases

+ There are no comments

Add yours