By Sarhind Times Bureau

The Enforcement Directorate (ED) has intensified its crackdown on financial irregularities in the real estate sector, raiding multiple premises across the National Capital Region (NCR) and attaching assets worth ₹153.16 crore. These actions target two major developers—International Recreation and Amusement Ltd (IRAL), associated with the once-iconic Appu Ghar group, and Universal Buildwell Pvt Ltd—both accused of defrauding thousands of investors through delayed, stalled, or incomplete projects.

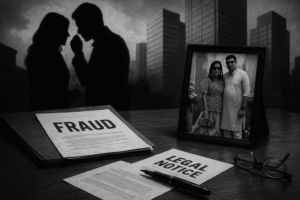

The investigation reveals how hard-earned savings of middle-class families were diverted into shell companies and personal luxury, instead of building promised homes and commercial complexes. For many, the dream of owning property in Gurugram has turned into a nightmare.

This latest action under the Prevention of Money Laundering Act (PMLA) comes amid growing scrutiny of the real estate sector, which has long been plagued by allegations of mismanagement, overleveraging, and outright fraud.

The Twin Cases: IRAL and Universal Buildwell

IRAL (International Recreation and Amusement Ltd) – The Appu Ghar Connection

Founded with a vision to create leisure and commercial hubs, IRAL raised substantial funds for projects in Gurugram’s Sector 29 and Sector 52-A. Sector 29 was especially high-profile, with plans for prime commercial complexes in the city’s entertainment district.

However, the ED’s probe shows that the company defaulted on delivery timelines and failed to hand over promised spaces to nearly 1,500 investors. FIRs filed by investors detail how advances were collected aggressively, but construction never progressed beyond preliminary stages.

What began as delays soon escalated into suspicions of fraud. According to investigators, IRAL allegedly diverted investor contributions into unrelated entities. Tracing the money trail revealed shell companies receiving funds, which were then layered through multiple accounts to disguise their origins before allegedly being siphoned off for personal enrichment.

Universal Buildwell – The Larger Web

Universal Buildwell’s case is broader in scope, with at least eight projects under scrutiny. Collectively, these projects raised over ₹1,000 crore. Many are still incomplete, with construction sites abandoned or progressing at a snail’s pace.

Buyers allege they were promised possession by 2018–2019. Today, most remain in limbo, locked in legal disputes and arbitration hearings. Universal Buildwell’s directors are accused of forging agreements, inflating invoices, and fabricating escrow arrangements to create the illusion of financial prudence.

In reality, much of the investor capital was routed into dummy corporations, personal accounts, or high-value assets unrelated to construction.

ED’s Enforcement Action

Based on FIRs registered by the Gurugram Police and Delhi’s Economic Offences Wing (EOW), the ED initiated raids across five locations in Delhi, Gurugram, and Noida. Officials seized documents, digital records, and froze multiple bank accounts linked to promoters and associated firms.

In its provisional attachment order, the ED seized ₹153.16 crore worth of assets. These include:

- Prime land parcels in Gurugram.

- Under-construction units tied to the disputed projects.

- Bank balances and movable properties linked to former promoters.

A prosecution complaint (equivalent to a chargesheet) has already been filed against some of the accused, with officials indicating more attachments could follow as forensic audits progress.

“Investor interests remain our top priority. The investigation is aimed not only at punishing offenders but also at recovering proceeds of crime so that cheated buyers can receive restitution,” an ED spokesperson told Sarhind Times.

The Human Cost: Buyers in Distress

Behind the numbers lies a deeper tragedy—thousands of middle-class families left in uncertainty. Many buyers invested their life savings, retirement funds, or took bank loans to secure a dream property.

Take the case of Anjali Sharma, a school teacher who booked a commercial unit in IRAL’s Sector 29 project. “We believed in Appu Ghar’s name. It had nostalgia, credibility. Now, after seven years, we are still without possession, paying EMIs on a property that only exists on paper.”

Similarly, Rajiv Mehta, a software engineer, invested in Universal Buildwell’s luxury housing project in Gurugram in 2016. “We were promised handover by 2019. Today, there is just an abandoned site. Every EMI feels like a punishment for trusting the wrong people.”

For such buyers, ED’s intervention is a glimmer of hope. But recovery remains uncertain. Even if assets worth ₹153 crore are liquidated, it will barely cover a fraction of the estimated ₹1,200–1,500 crore defrauded across both companies.

A Pattern of NCR Realty Scams

The IRAL and Universal Buildwell cases are not isolated. Over the past decade, NCR has witnessed repeated instances of real estate fraud:

- Amrapali Group – Over ₹3,000 crore diverted; buyers left stranded.

- Unitech Ltd – Multiple stalled projects; promoters arrested.

- Jaypee Infratech – Thousands of homebuyers still awaiting flats.

The common thread is systemic misuse of buyer advances. Developers often launched multiple projects simultaneously, collecting funds from one to finance another, creating a Ponzi-like cycle. When market slowdowns hit, the cycle collapsed, leaving projects abandoned.

Despite RERA (Real Estate Regulation and Development Act, 2016) creating a framework to safeguard buyers, enforcement gaps persist. Many projects launched before RERA continue to fall into legal grey zones.

Legal Framework and Challenges

The ED’s actions are anchored in the Prevention of Money Laundering Act (PMLA). By attaching assets, the agency ensures suspected proceeds of crime cannot be sold or transferred. However, actual restitution requires lengthy court proceedings, with buyers often stuck in protracted battles before recovery is possible.

Legal experts caution that criminal prosecutions alone may not resolve investor grievances. “Civil remedies, including liquidation and RERA-led adjudication, must complement criminal probes. Otherwise, attachment orders may delay resolution,” notes Supreme Court advocate Manisha Sethi.

Meanwhile, the accused promoters are likely to contest ED’s charges in appellate tribunals, dragging timelines further.

Government’s Tightening Grip

The crackdown reflects a broader government strategy to restore confidence in India’s real estate market, one of the largest generators of employment and GDP.

Key initiatives include:

- Strengthening RERA enforcement.

- Fast-tracking insolvency cases under IBC (Insolvency and Bankruptcy Code).

- Empowering buyers to act as financial creditors in resolution processes.

- Increasing coordination between police, EOW, and central agencies.

Finance ministry officials emphasize that such interventions are critical to attracting both domestic and foreign investment.

What Lies Ahead?

For now, ED’s raids have sent a clear message: real estate fraud will not be tolerated. Yet, much depends on judicial follow-through. If assets can be liquidated and proceeds distributed efficiently, confidence among buyers may be restored.

For cheated investors, the road ahead remains long and uncertain. But with ₹153 crore worth of assets now frozen, the first steps towards accountability have been taken.

Conclusion

The NCR real estate sector, once a magnet for investors and end-users alike, has become a cautionary tale of overpromises and betrayals. The ED’s crackdown on IRAL and Universal Buildwell is both a warning to unscrupulous developers and a lifeline for victims.

As the investigations widen, one question looms large: will this finally be the turning point where regulation, enforcement, and justice converge to protect India’s most vulnerable investors?

Only time—and the courts—will tell.

#ED #RealEstate #Gurugram #InvestorSafety #NCR #PMLA #Fraud #AppuGhar #UniversalBuildwell #IRAL #SarhindTimes

+ There are no comments

Add yours