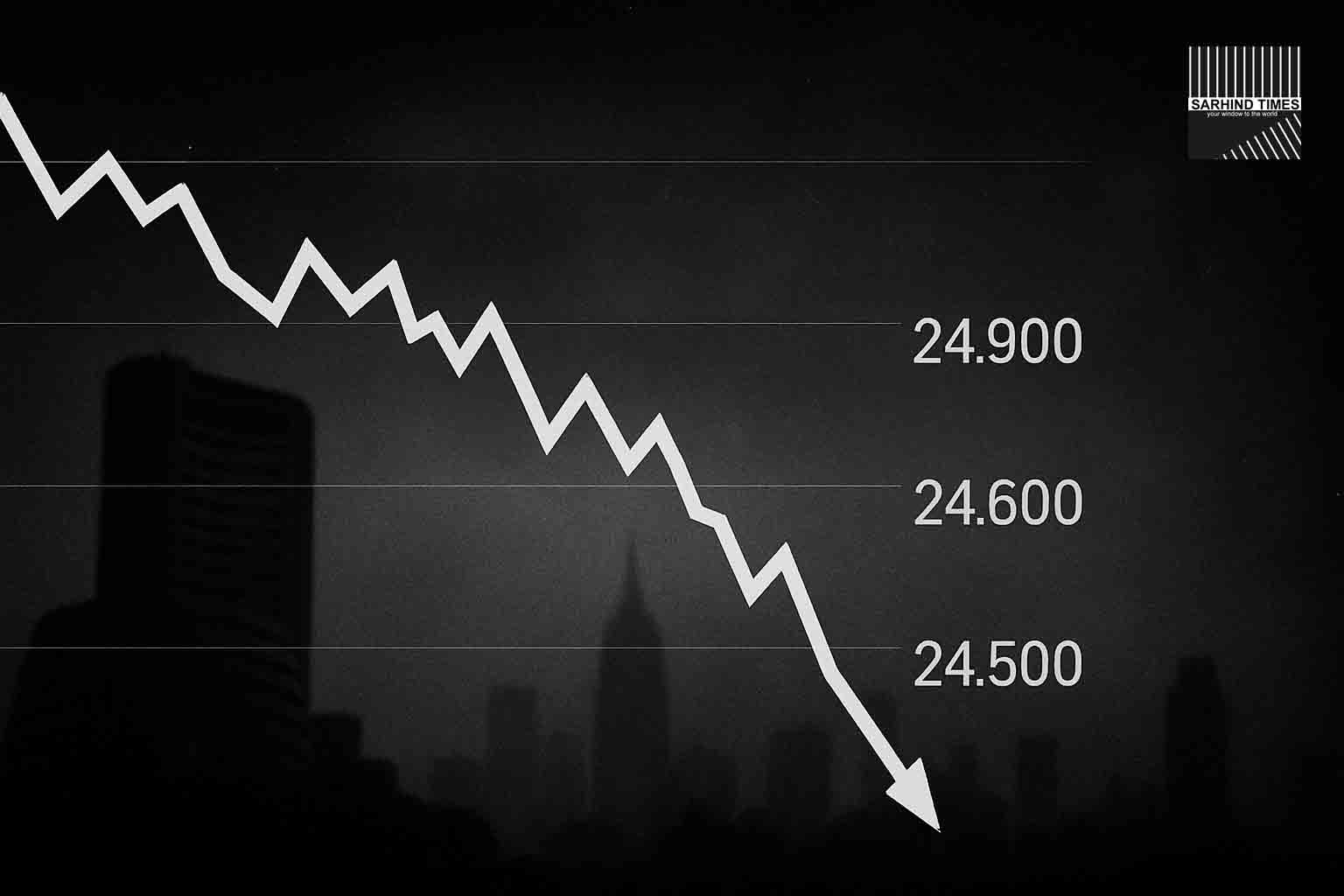

After a sharp 166-point slide, the Nifty 50 index extended its losing streak to five sessions, slipping decisively below the psychologically important 24,900 “pivot.” The market mood on Dalal Street is cautious and defensive: technically weak, sentiment fragile, and participants seem to be waiting for clearer direction. The near-term battle is between sustaining a bounce above 24,900 and a slide toward 24,600–24,500 support territory.

In this piece, we break down the technical structure, sectoral cues, derivative & flows signals, risk–reward scenarios, and strategy views for participants.

Market Context & Recent Price Action

On Thursday, the Nifty plunged ~166 points (≈ -0.66 %) to close around 24,890.85.

This drop comes after a string of weak sessions, with the index failing to hold near 25,000–25,100 zones.

Technical analysts flag that the cluster support around 24,900 (comprising an ascending trendline, 10-week EMA, and overlapping pivot zones) has now been broken.

Below 24,900, the next key supports are seen near 24,700, 24,600 and further down toward 24,500 region.

Momentum indicators, including RSI, stochastic oscillators, and moving average alignments, are turning negative or have already crossed to weak zones across daily/weekly frames.

Hence, until the index can recapture and sustain above 24,900 (or ideally 25,000-25,100), the bias remains toward the downside or range-bound with a bearish tilt.

Technical Levels to Watch

| Level | Role / Significance | Scenario if broken / held |

|---|---|---|

| 24,900 | Former pivot / support; trend control level | If reclaimed decisively, may dampen near-term bearishness. But failure to reclaim will solidify lower bias. |

| 25,000 – 25,100 | Resistance zone; call writing zone in derivatives | A sustained move above this could trigger a short covering rally. |

| 24,700 | Near support zone | If broken, open path to 24,600 / 24,500 |

| 24,600 – 24,500 | Critical support cluster | A breach below this may signal deeper correction; a rebound here could act as short-term base |

| 24,300 | Potential fallback support in deeper correction | Last resort zone; would be watched for heavy oversold recovery attempts |

Derivative & Flow Signals

- Options / Open Interest: According to reports, heavy call writing is noticed at higher strikes, indicating that many participants expect resistance to hold in upper zones.

- Put Call Ratio (PCR): Elevated PCR levels in near‐term series suggest hedging demand or defensive bias.

- FII / DII flows: With foreign institutional investors reportedly net sellers, the pressure is on. The ability of domestic institutional inflows (via mutual funds, SIPs) to absorb the selling will be critical to stability.

- Volatility / Implied vols: Weekly expiry volatility remains elevated, raising the risk of intraday whipsaws and false breakouts.

These derivative cues amplify the message: participants are cautious, positioning is defensive, and the market is vulnerable to directional surprises.

Sectoral & Thematic Observations

- Banks and IT: Underperformance in these two heavyweight sectors has accentuated the bearish tone, especially as global cues (e.g. US yields, macro data) dampen risk appetite.

- High-beta counters / global-linked names: Likely to be more volatile, and will tend to get oversold in weakness or overbought on relief.

- Defensives / large caps with earnings visibility: These may attract safer accumulation flows in weakness.

- Currency & macro linkages: Moves in USD/INR (DXY path), global yields, and macro surprises (US data, Fed commentary) will influence the opening bias and direction.

Given quarter-end rebalancing, stocks with weight adjustments might see additional volatility.

Risk / Reward Scenarios & Possible Paths

Let’s consider a few plausible paths in the near term:

Scenario A – Recovery / bounce

If the Nifty can reclaim 24,900 and push through to 25,000–25,100 with decent volume, we could see a relief rally, short covering. However, this move must clear resistance decisively, else it will likely fade.

Scenario B – Gradual Slide

The more likely scenario given current technicals: Nifty drifts lower in steps. It first tests 24,700, then 24,600. A bounce attempt may emerge there. The 24,500 zone is critical — if lost, deeper correction toward 24,300 or 24,000 becomes feasible.

Scenario C – Breakdown of 24,500

If the index cuts below the 24,500 zone with momentum, it may trigger a sharper slide, as stop-loss cascades and confidence erodes further.

Key triggers / catalysts to watch

- Overnight US macro data / Fed commentary

- Global risk markets (US, China, Europe)

- Currency moves (USD/INR)

- FII flows

- India macro surprises / government announcements

- Quarterly earnings surprises in large caps

Therefore, every move should be assessed in the context of catalysts and confirmation volumes.

Strategy Views: What Investors & Traders Should Do

For short-term / intraday / momentum traders

- Be nimble. Don’t over-commit.

- Watch for strong reversal patterns (bullish engulfing, RSI dips) near support zones.

- Use tight stop-losses. If 24,600–24,500 breaks convincingly, bail out or hedge.

- Favor stocks with clear technical setups rather than betting the broader index.

For medium-term / investors

- Rather than lump sum buys, adopt staggered accumulation in quality large caps with solid earnings visibility, especially when the index hits critical support zones.

- Maintain hedges — e.g. by using index puts or trailing stop limits.

- Avoid chasing rallies unless several key resistance zones are convincingly broken.

- Use sectoral rotation: defensive sectors may provide relative strength in turbulent times.

Risk controls

- Stay alert to false breakouts (both on upside and downside).

- Monitor derivative implied volatility — sharp spikes could indicate reversal zones.

- Liquidity matters: avoid entering positions near the end of sessions without conviction.

Forward Outlook & Timeline

- Short term (1–2 weeks): Expect range bound movement between 24,600 and 25,000, with elevated volatility.

- Intermediate (monthly): If the 24,500 zone is breached decisively, the downside may extend toward 24,300 or lower. Conversely, a clean break above 25,000–25,100 could signal renewed upside.

- Longer term (3–6 months): The trend will depend on macro & earnings cycles, foreign flows, and global liquidity. If India’s fundamentals remain solid, and global headwinds ease, the market may reassert a bullish bias over time.

Closing Thoughts

The Nifty is entering a delicate phase. While the break of 24,900 raises the odds of further downside in the 24,600–24,500 territory, the overall structure still allows for a reversal if the index reclaims resistance decisively. The path forward will be shaped more by catalyst events, flows and conviction than by pure technical momentum.

In such uncertain terrain, careful position sizing, risk controls, staggered entries, and patience will be more important than bold directional bets.

#StockMarket #Nifty50 #Sensex #Equities #DalalStreet #FIIFlows #Markets #TechnicalAnalysis #IndianMarkets

+ There are no comments

Add yours