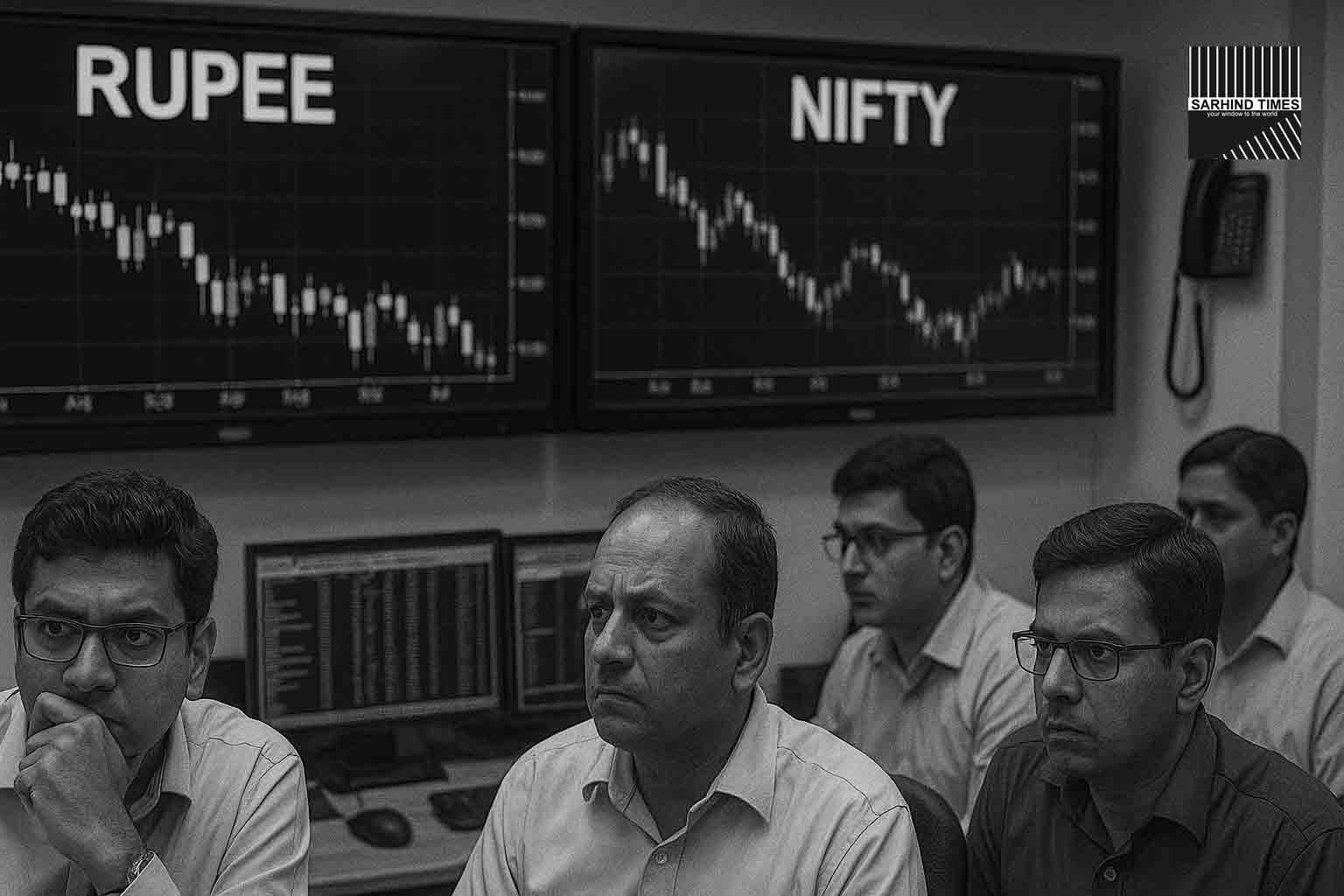

Dalal Street is bracing for a cautious open, with traders closely watching how global risk sentiment, the rupee’s slide, and sectoral churn will shape today’s session. Pre-open indicators point to a mixed start for the Nifty, with the spotlight firmly on banks, IT, and rupee-sensitive sectors such as autos and electronics.

This comes amid a backdrop of volatile global yields, shifting commodity prices, and policy speculation at home. For traders, today’s setup is less about sweeping directional calls and more about selective positioning.

Currency & Macro Backdrop

The rupee’s fall to record lows near 88.80 per dollar remains the biggest overhang. While exporters in IT and pharma may find a cushion, import-heavy industries could face immediate margin pressures. Oil remains another swing factor, with Brent crude’s recent firmness threatening to erode macros further.

Meanwhile, domestic macro cues like upcoming PMI prints and any fresh Centre commentary on import duties—especially for autos and electronics—could sway sentiment in the near term.

Banks: Holding the Fort

The banking pack showed resilience in the last session, stabilising broader market sentiment. Traders are eyeing Bank Nifty’s put walls as a possible intraday floor, with levels around 25,000–25,300 highlighted as crucial by options writers. Private lenders, in particular, could steady the tape if credit growth and festival-quarter loan demand trends continue to show strength.

IT: Double-Edged Sword

The IT sector remains a “watch pocket.” Headlines around US visa fee hikes have unsettled investor sentiment, but dollar strength provides a partial offset through currency-led tailwinds. Analysts suggest stock-specific action will dominate, with export-heavy names benefitting from rupee weakness, while firms reliant on onshore costs may feel the pinch.

Sector Rotations & Stock-Specific Action

- Consumers: Guidance updates during the festival quarter will be key.

- Autos & Electronics: Sensitive to any changes in import duty or rupee weakness.

- Pharma: Potential relative outperformance, given export linkages.

- Metals: May trade in sync with global commodity flows.

Traders are also expecting block deals and large-cap rebalancing flows to trigger stock-specific volatility in early trade.

Technical Picture

Options writers suggest:

- Nifty Range: 25,000–25,300 is the zone to watch.

- Bank Nifty: Heavy put-writing suggests possible support levels intraday.

- Gap Patterns: Keep an eye on the pre-open page and tick data for signs of early gaps being filled or extended.

Global Cues

Overnight, Wall Street provided no strong directional lead, with traders cautious ahead of fresh US macro data. Asian peers are mixed, with commodity-linked markets outperforming. The firm gold bid globally is being seen as a defensive signal, reflecting investor hedging.

Conclusion

Today’s trade setup is all about balancing caution with selective bets. Banks are expected to anchor sentiment, IT remains the most scrutinised sector, and rupee-sensitive stocks could dictate intraday swings. Traders will also keep a close eye on PMI prints, oil trends, and global bond yields into the evening.

For Dalal Street, the day may start cautiously—but volatility promises opportunities for those tuned into tick-level data.

#StockMarket #Nifty #Sensex #BankNifty #PreOpen #DalalStreet #Equities #RupeeWatch

+ There are no comments

Add yours