The Securities and Exchange Board of India (SEBI) has approved a major reform package that is expected to make India’s capital markets more accessible, especially for foreign investors and large issuers. Announced at the SEBI board meeting in Mumbai on 12 September 2025, the changes include significant amendments to IPO norms, public float requirements, related-party transaction disclosures, and foreign investor entry routes.

Key Reforms

- Reduced Minimum IPO Share Sale: For companies with post-listing market capitalisation exceeding ₹5 trillion, SEBI has cut the minimum share sale required in an IPO from 5% to 2.5% of post-issue share capital.

- Extended Timeline for Public Float Requirement: Firms are given more time to meet the mandatory public shareholding norms: companies with public shareholding below 15% at listing may now take 5 years to raise to 15%, and 10 years to reach 25%, depending on their size and market cap.

- SWAGAT-FI Framework: A new framework called SWAGAT-FI (Single Window Automatic & Generalised Access for Trusted Foreign Investors) has been introduced. It will provide a more streamlined registration and compliance process for eligible foreign portfolio investors, sovereign funds, public retail funds, pension funds, etc.

- Anchor Investor Norms & Public Offer Allocations: Anchor investor reservations have been increased (to 40% of issue size in some cases) and expanded to include life insurance companies and pension funds alongside mutual funds. This is expected to deepen the investor base and bring more stability to large IPOs.

- Simplified Related Party Transaction Rules: SEBI has introduced scale-based thresholds for when related-party transactions require disclosure or shareholder approval, reducing compliance burden for lower-value transactions.

Impact & Rationale

These reforms are driven by several factors:

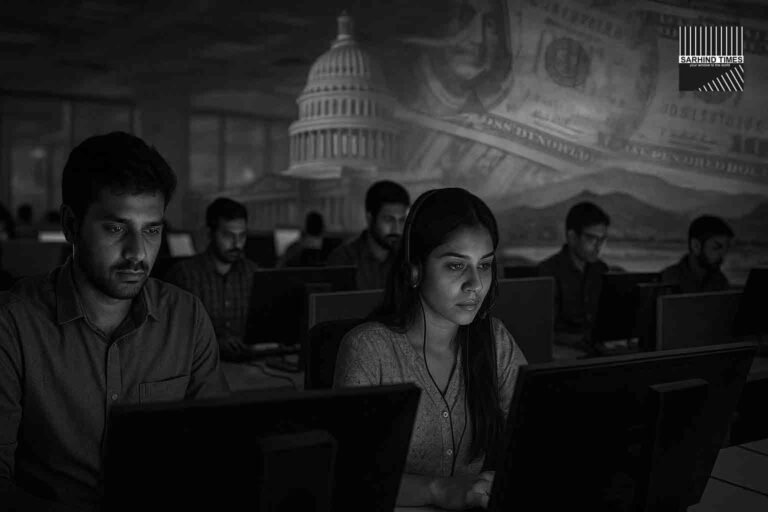

- Foreign Capital Outflows: India has faced persistent outflows of foreign portfolio investment (FPI) and debt in 2025, attributed to weak global earnings, high U.S. tariffs, and concerns about relative valuations. The easing of norms is aimed at reversing that trend by making markets more inviting to overseas investors.

- Liquidity & Dilution Concerns: Large IPOs often face resistance because of the dilution of shareholding and required large public offers. By lowering minimum sale thresholds and allowing phased compliance for public float, SEBI hopes to reduce upfront pressure on companies and make IPOs more viable.

- Governance & Market Depth: Including pension funds and insurers in anchor investor quotas, and expanding access through SWAGAT-FI, should deepen participation and diversify risk. Simplifying related party transaction rules helps reduce regulatory friction.

Challenges & Considerations

While the reforms are broadly welcomed, some observers point out potential risks and trade-offs:

- Retail Investor Interest: Reduced dilution and phased public float rules could mean less immediate availability of shares for small retail investors, possibly dampening interest among them.

- Corporate Exploitation: There is a concern that companies might exploit relaxed norms – for example by listing with very low public float and delaying increasing it, potentially reducing transparency or governance pressure in the short term.

- Market Absorption: Even with lower minimum IPO share sales, mega offers still require strong demand. If investor sentiment is weak, large IPOs may still struggle.

- Regulatory Oversight: Simplification of norms must be balanced with strong monitoring to prevent misuse, insider abuses, or related party concerns.

Broader Context & International Comparisons

Globally, capital markets regulators often adjust IPO and foreign investor norms to respond to capital flows, competitiveness, and investor confidence. India’s move reflects comparable efforts in jurisdictions like Singapore, Hong Kong, and the UAE, where regulatory reforms have aimed to reduce friction for foreign institutional money.

India, being one of the world’s largest IPO markets, is under pressure to maintain momentum. With 2025 projected to see record IPO fundraising ($17-20 billion or more), per several reports, these reforms may help sustain or boost that pace.

Conclusion

SEBI’s recent regulatory changes mark a significant shift aimed at making India’s capital markets more foreign investor-friendly, easing compliance burdens, and giving large companies more flexibility in IPOs and public float requirements. If implemented well, the reforms could help reverse capital outflows, revive IPO activity, and bolster investor confidence. However, safeguarding investor rights and ensuring transparency will be key to balancing ease with accountability.

As these norms come into being, both companies planning IPOs and foreign investors will need to adjust strategies. Watch areas include which firms take advantage first, how anchor investor pools behave, and whether retail investor participation remains strong under the new regime.

#SEBIReforms #IPORegime #ForeignInvestors #CapitalMarkets #MakeIndiaInvestable #PublicFloatNorms #SWAGATFI #MarketRegulation

+ There are no comments

Add yours